As predicted yesterday, the EUR/USD currency pair continued to decline on Monday, albeit with less volatility. Given that neither the US nor the EU released any significant macroeconomic information or basic background yesterday, the movement on Monday best satisfies the definition of "inertial." Thus, the euro's value continued to decline entirely as a result of last week's events, notably the outcomes of the Fed and ECB meetings and the American media's publications on Friday. This movement could finish today and an upward correction could start because we predicted it would last for another one or two days. We continue to anticipate that the European currency will continue to decline. A downward trend is the most likely course of action given the pair's recent extreme overbought condition. Additionally, sales signs are also beginning to emerge. The pair was fixed below the moving average line on the 4-hour TF, which is noteworthy. Today, the price can already pass the crucial threshold on the 24-hour TF. When these two signals are merged, the pair can fall by hundreds of points.

Additionally, we must keep in mind that there won't be much in the way of macroeconomic and fundamental background this week. There won't be any significant reports, and Christine Lagarde's address didn't reveal any new information. What additional information could there possibly be given that practically all ECB officials have recently stated the necessity of continuing to tighten monetary policy? Since the regulator would have already started a modest slowdown if it wanted to stop its tightening, there is now no question that the rate will increase by at least 0.75%. There will be at least two more increases of 0.5% and 0.25% if it does not slow down at the February meeting.

The ECB's planned tightening of monetary policy, however, is a "double-edged sword." Since the market is already prepared for such an event, quotes can already reflect it. Therefore, rhetoric with a longer-term view is needed from Christine Lagarde, Luis de Guindos, or Isabelle Schnabel. If they give any indication or make it clear that they intend to raise the rate in the second half of 2023, this might lead to a new round of buying of the euro since the Fed rate will have undoubtedly risen by then.

Can the inflation rate rise again?

Another option is to approach the issue differently. Both in the United States and the European Union, inflation has been slowly declining over the past few months. A lot of individuals, who have grown accustomed to this phenomenon, think that the consumer price index will now decline (at some rate or another) until it reaches 2% or such. A year is implied. The fact that inflation has been falling in recent months as a result of lower energy transport prices is not surprising. The impact of this occurrence will eventually stop having an impact on prices, and inflation may then stop accelerating. In a few months, this will likely occur. It is also important to keep in mind that the effects of a rapid rate increase by the ECB and the Fed may eventually "fade into the background." If the rate has increased to 4.75% (in the US), it does not follow that inflation will continue to decline indefinitely. The Fed will need to decrease the key rate quickly to stop inflation. In general, we think that the monetary policies of the Central Bank may be changed more than once in 2023. As a result, making long-term predictions is useless. To make them, too many aspects must be taken into account. By the way, the armed confrontation in Ukraine is still going on and has not ended. Everyone is aware of the terrible effects it had on the pound and the euro last year. This year, history might repeat itself.

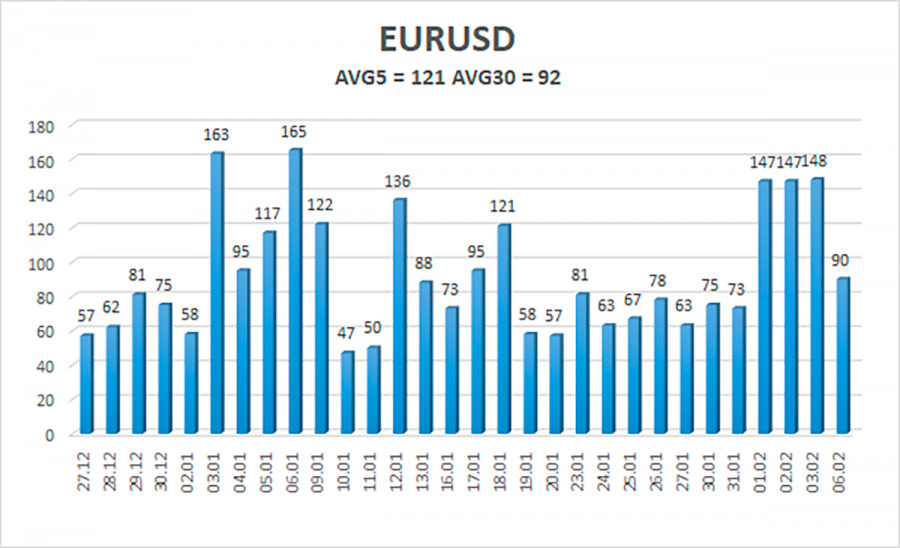

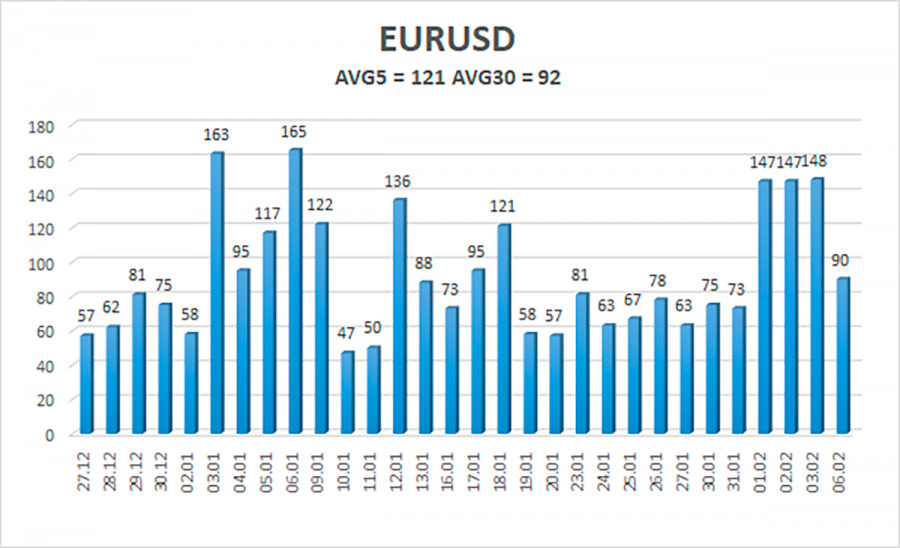

As of February 7, the euro/dollar currency pair's average volatility over the previous five trading days was 121 points, which is considered "high." So, on Tuesday, we anticipate the pair to move between 1.0614 and 1.0856. The Heiken Ashi indicator's upward reversal will signal a round of corrective movement.

Nearest levels of support

S1 – 1.0742

S2 – 1.0620

S3 – 1.0498

Nearest levels of resistance

R1 – 1.0864

R2 – 1.0986

R3 – 1.1047

Trading Advice:

The EUR/USD pair is still moving lower. Until the Heiken Ashi indicator turns up, you can maintain short positions with a target price of 1.0620. After the price is fixed back above the moving average line, long positions can be initiated with a target of 1.0986.

Explanations for the illustrations:

Channels for linear regression - allow us to identify the present trend. The trend is now strong if they are both moving in the same direction.

Moving average line (settings 20.0, smoothed): This indicator identifies the current short-term trend and the trading direction.

Murray levels serve as the starting point for adjustments and movements.

Based on current volatility indicators, volatility levels (red lines) represent the expected price channel in which the pair will trade the following day.

A trend reversal in the opposite direction is imminent when the CCI indicator crosses into the overbought (above +250) or oversold (below -250) zones.