The GBP/USD currency pair continued its downward movement on Tuesday. The chart above may suggest that we are dealing with a strong trend, and indeed, this is true, but it is important to understand one very important detail. The downward movement cannot be called strong because the volatility is currently low and the pound is losing value by 20–30 points a day. At the same time, we do not see any retracements or corrections; the pair simply continues to fall not just every day but every hour. It is through this factor that the overall strength of the trend is achieved.

Based on an understanding of the nature of this movement, it can be said that trading in the short term is currently impractical. Intraday movements are weak, so any position potentially cannot even yield average profits. The only option is to hold positions for several days, and for that, you need to trade on the 4-hour or 24-hour timeframe without reacting to Heiken Ashi indicator reversals since it is a fast indicator and there is currently no correction. So, it turns out that it reverses in vain. The same applies to the CCI indicator, which has already indicated strong oversold conditions three times, but we have not seen any hint of a correction. Therefore, the conclusion is evident: to identify a correction, one should wait for the price to consolidate above the moving average.

And the last thing to add is that the pound's downward movement is absolutely logical and regular, but the character of the movement is inertial. This means that market participants are practically selling the pound every day, even when there are no local reasons for it. How long such a movement can continue is an open question. It is worth remembering how much the pound rose when there was no basis for it. Of course, we are not counting on growth for 3–4 months without a single correction, but in general, we expect the pound to continue its decline.

The Fed is ready to raise rates again. While the market has been disappointed in the Bank of England, which has decided to prepare for the end of the tightening cycle of monetary policy, the Fed may raise the key rate once or twice more. It doesn't matter that the Bank of England may also raise the rate once or twice more. The market has absorbed these increases over the course of a year, simultaneously ignoring all the "hawkish" actions of the Fed. Thus, the fact that the British regulator may tighten monetary policy means nothing for the pound. The fact that the American regulator may tighten policy will now support the dollar.

Susan Collins, the head of the Federal Reserve Bank of Boston, stated yesterday that rates in the United States may need to be held higher and longer than previously thought. There is nothing surprising in this rhetoric, as inflation in the United States has been rising for two consecutive months, and the Federal Reserve has the necessary tools to continue tightening or keep the rate at highs for an extended period. In recent months, energy prices have been rising, which will stimulate the consumer price index to new growth. However, let's reiterate that the Federal Reserve has the necessary tools to continue fighting inflation in real-time rather than simply fixing the rate and hoping that inflation will drop to 2% in a few years. The dollar remains in a more advantageous position.

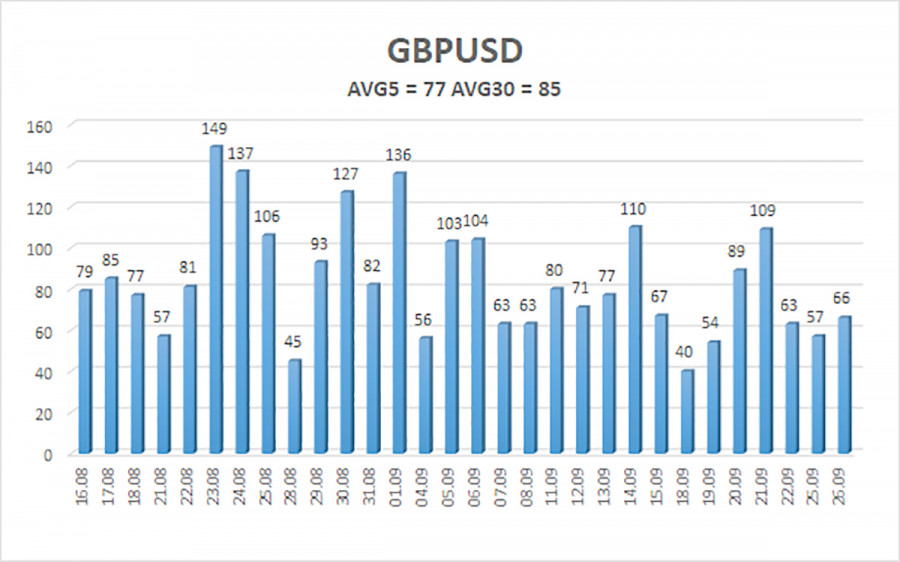

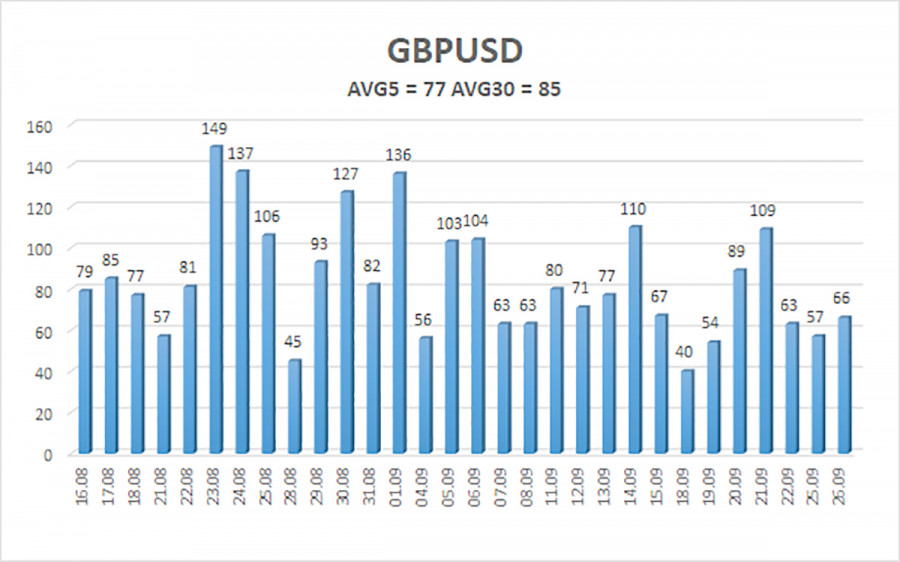

The average volatility of the GBP/USD pair over the last 5 trading days as of September 27th is 77 points. For the pound/dollar pair, this value is considered "average." Therefore, on Wednesday, September 27th, we expect movement within the range bounded by 1.2063 and 1.2217. A reversal of the Heiken Ashi indicator upwards will signal a possible upward correction.

Nearest support levels:

S1: 1.2146

S2: 1.2085

Nearest resistance levels:

R1: 1.2207

R2: 1.2268

R3: 1.2329

Trading recommendations:

In the 4-hour timeframe, the GBP/USD pair continues to hover near its local lows and updates them every day. Therefore, at this time, it is advisable to stay in short positions with targets at 1.2085 and 1.2063 until the price consolidates above the moving average. Consideration of long positions will be possible only after the price consolidates above the moving average, with targets at 1.2329 and 1.2390.

Explanations for the illustrations:

Linear regression channels help determine the current trend. If both channels are pointing in the same direction, it indicates a strong trend.

The moving average line (settings 20.0, smoothed) determines the short-term trend and the direction in which trading should be conducted at the moment.

Murray levels: target levels for movements and corrections.

Volatility levels (red lines): the probable price channel in which the pair will move in the next day based on current volatility indicators.

CCI indicator: its entry into the overbought region (above +250) or oversold region (below -250) indicates that a trend reversal in the opposite direction is approaching.