The quote sharply slowed down as soon as it reached the control level, so we can consider it a breakdown or a temporary phenomenon – we will analyze this issue in our article.

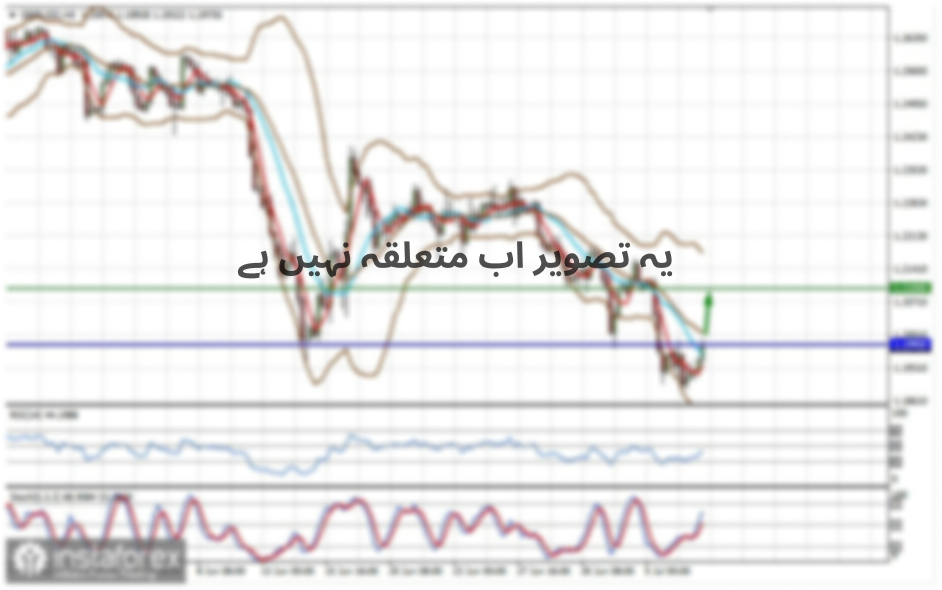

From the point of view of technical analysis, we see all the desired breakdowns of the pivot point of 1.1080, which for a long time kept the quote and at the same time was the first stage of the recovery process relative to the oblong correction. So it came against the background of working off the resistance level of 1.1180 and strengthening against the background of the information flow, the quote went to the assault, where at first there was an impulse passage, after which it rolled back and again, touching at the same time the control point 1.1060, which was the start coordinator for many traders. So can this be considered a breakdown? Yes and no. So, analyzing the behavior of quotes, we are faced with a clear process of formation, where there are both buyers and sellers. Thus, the transfer of trade forces forms a low-amplitude oscillation, that is, a variable corridor, which can serve as amplification for further decline, and the appointment of a new status of the passed level of 1.1080 – range level of 1.1080 (1.1060/1.1080/1.1090). At the same time, analyze the trading chart on the H4 period, where our analysis is conducted, you will see that there was no breakdown of the mark of 1.1060.

In terms of volatility, an extremely low indicator of 28 points was recorded yesterday, which is 49% lower than the daily average. Probably, one of the reasons for the decrease in amplitude was due to the indecision of market participants to a further decrease, but at the same time, there were no particular buyers.

Analyzing the hourly past day, we see that in the first half of the day there was a slight pullback, after which from 12:00 to 19:00 (time on the trading terminal) an attempt to restore the downward interest. The day ended with a narrow consolidation of 5-8 points.

As discussed in the previous review, many fixed their previously available short positions as soon as the quote approached the benchmark level of 1.1080. Further actions were in monitoring the values of 1.1060/1.1100 in terms of further work. As a result, the quote did not show itself in any way, and the set values were not broken, as a result, traders continued to monitor without open trade deals. In turn, speculative operations have yielded small, but still fruits in the phase of the pullback. The forecast with the movement to 1.1090-1.1095 coincided.

Looking at the trading chart in general terms (daily period), we see a kind of deja vu, where the quote in the recovery phase again reached the first stage in the face of the level of 1.1080. The question is whether this time it will be possible to extend the existing course or we will again find ourselves in the same framework of 1.1080/1180. Let me remind you that in terms of trends, we are still in a downward trend (the tact of the existing trend from the beginning of 2018 to the present).

The news background of the past day contained data on retail sales in Europe, where the previous data was reviewed for the better by 2.1% – 2.7%, and the current figures came out even better than the forecast of 3.1%. In turn, a package of statistical data was released for European countries, where in some respects there are improvements. So, in Germany, they revised data on production orders -6.5% – -5.4%. Yes, we see a slowdown, but now at least there is some hope for improvement. At the same time, we had PMI indicators, the index of business activity in the services sector: France from 51.1 to 52.9; Germany from 51.4 to 51.6; Italy from 51.1 to 52.9; Spain from 53.3 to 52.7.

The market's reaction to the statistics may have been just in the pullback phase, but not significant.

The background information is steeped in the noise of US-China trade relations, as well as the regular Brexit.

So, US-Chinese relations began to sparkle with new colors as soon as news appeared that Beijing was planning to get Washington to abolish tariffs on a number of Chinese goods. Subsequently, this news began to grow into details, rumors, and intrigues.

• Rumor – a meeting between the two leaders to sign the first part of a trade deal between the countries could be delayed until December.

• Intrigue – China has identified the condition for reaching the first part of a trade deal with America.

• Details – Beijing and Washington are in the process of agreeing on a phased reduction of trade duties.

In fact, the latest information came to us on Thursday, where the official representative of the Ministry of Commerce of China Gao Feng said about the process of agreements between the two countries.

"If China and the USA reach an agreement of the first stage, both parties must simultaneously roll back the existing additional tariffs in the same proportion based on the content of the agreement, which is an important condition for reaching an agreement," Gao Feng said.

By tradition, we will complete our information background with Brexit news.

Now Brexit is entrusted with the stumbling block on such a difficult issue on the English side, and there the parliamentary elections are flaring up in full force. So, there are three British parties agreed to vote against Brexit in the election

"We are glad that the agreement has been reached. This is an important moment for all people who want to support candidates for EU membership throughout the country," Liberal Democrat leader Jo Swinson said.

At the same time, the former Speaker of the House of Commons of the British Parliament, John Bercow, decided to open up confrontation, as the former European Commission President Jean-Claude Juncker had done before. So, Bercow honestly stated that he considered Brexit the biggest foreign policy mistake of the post-war period.

"But my personal opinion is that Brexit does not meet our interests, we are part of the political bloc, the trade bloc. And I think it's better to remain part of the political bloc," John Bercow said.

Today, in terms of the economic calendar, we have data on applications for unemployment benefits in the United States, which should be reduced by 10 thousand.

Further development

Analyzing the current trading chart, we see a small momentum returning us to the area of the level of 1.1080. In fact, nothing drastic has happened yet. Yes, there is a small pullback from the lows. Yes, there is interest from buyers, but the movement is still purely inside the level. That is, in the case of restrained interest, the formation of a periodic corridor of 40-50 points along the control level is a very real picture. In turn, market participants are at a crossroads, as long positions seem to look attractive, and short ones too. In terms of volatility, the indicators are already better than the last day, let's see what happens next.

Detailing the available time interval every minute, we see that the morning stagnation at the lows was revised by market participants, and long positions reappeared, forming a local surge of 09:00 to 10:30 (trading terminal time).

In turn, the main part of traders is still waiting, as the breakdown of control values has not yet occurred 1.1060/1.1100. Speculators are trying to work on the uncertainty of the market, where at the moment of stagnation at key levels they fly into positions.

It is likely to assume that the chatter within 1.1060/1.1100 will still remain for some time, but I think this is not for long, the formation is necessary in this case. Thus, the working method will be based on the analysis of fixation points with respect to specified boundaries (1.1060/1.1100), preferably with confirmation of the Bullish/Bearish mood.

Based on the above information, we derive trading recommendations:

- Buy positions are considered in the case of a clear price-fixing higher than 1.1100.

- We consider selling positions in the case of a clear fixation of the price lower than 1.1060.

Indicator analysis

Analyzing different sector timeframes (TF), we see that the indicators in the intraday and medium-term periods retain downward interest, which reflects the attempt to achieve the second stage of recovery. Short-term intervals work on a pullback, showing variable upward interest.

Volatility per week / Measurement of volatility: Month; Quarter; Year.

Measurement of volatility reflects the average daily fluctuation, calculated for the Month / Quarter / Year.

(November 7 was built taking into account the time of publication of the article)

The volatility of the current time is 31 points, which is the average for this period. It is likely to assume that if there is no hovering within the specified limits and we see a breakdown of control values, then the chance of accelerating volatility will take place in the market.

Key level

Resistance zones: 1.1080**; 1.1180*; 1.1300**; 1.1450; 1.1550; 1.1650*; 1.1720**; 1.1850**; 1.2100.

Support zones: 1.1080**; 1.1000***; 1.0900/1.0950**; 1.0850**; 1.0500***; 1.0350**; 1.0000***.

* Periodic level

** Range level

*** Psychological level

***** The article is based on the principle of conducting transactions, with daily adjustments.