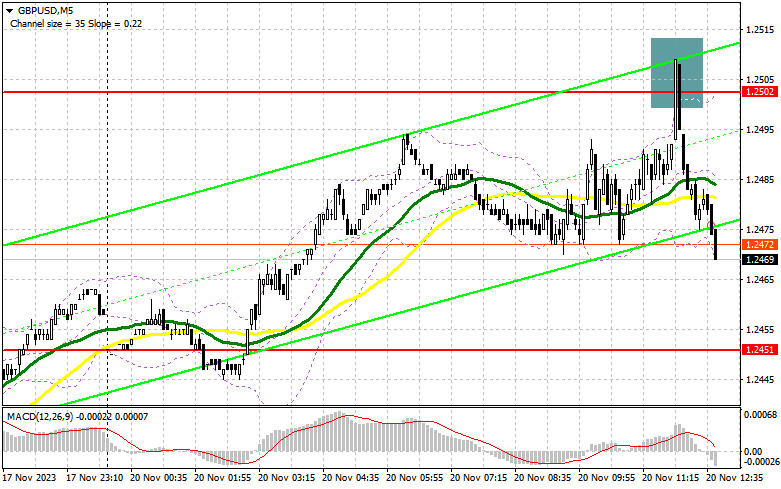

In my morning forecast, I drew attention to the level of 1.2502 and recommended making decisions on market entry based on it. Let's look at the 5-minute chart and analyze what happened there. The rise and the formation of a false breakout at this level allowed for an entry point into short positions, which, at the time of writing the article, had already resulted in a pair's decline by more than 30 points. The technical picture remained unchanged for the second half of the day.

To open long positions on GBP/USD, the following is required:

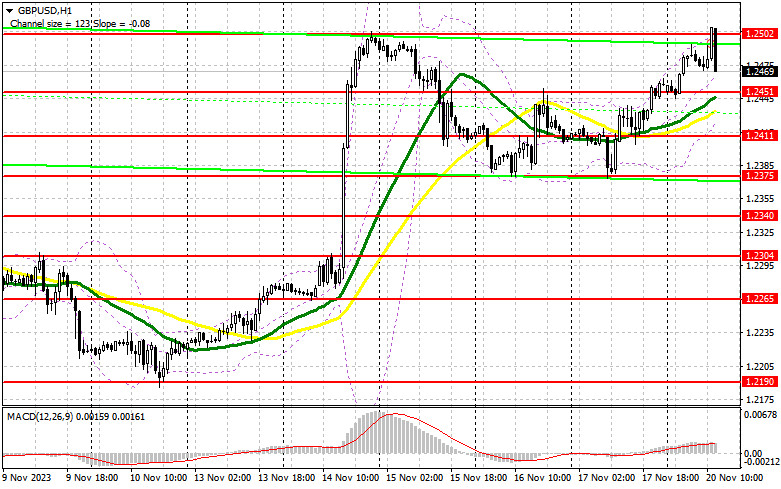

The absence of US statistics will likely keep trading within a sideways channel, so I will act solely based on the morning scenario. Only the formation of a false breakout around the nearest support at 1.2451 will provide an entry point into long positions in continuation of the upward trend with the target of another update of this month's maximum at 1.2502, which has not been surpassed yet. A breakthrough and consolidation above this range will lead to a new signal to open long positions with an exit at 1.2543. The ultimate target will be the area of 1.2581, where I will take profit. In the scenario of the pair's decline and the absence of activity at 1.2451 from buyers in the second half of the day, it will not significantly affect the development of the bullish trend. Still, the chances of consolidating above the monthly maximum will decrease. In this case, only a false breakout around the next support at 1.2411 will give a signal to open long positions. I plan to buy GBP/USD immediately on the rebound, only from 1.2375, with the target of a correction of 30-35 points within the day.

To open short positions on GBP/USD, the following is required:

Bears successfully defended the monthly maximum. As long as trading is conducted below this range, one can expect a more significant downward movement of the pair towards the daily minimum. In case of another upward surge of GBP/USD, I plan to sell again after the formation of a false breakout around 1.2502, which will provide a chance for a downward movement towards support at 1.2451, just below which the moving averages, playing on the side of buyers, intersect. Only a breakthrough and a reverse test from the bottom to the top of this range will deal a more serious blow to buyer positions, leading to stop-loss triggering and opening the way to 1.2411. The more distant target will be the area of 1.2375, where I will take profit. In the scenario of GBP/USD growth and the absence of activity at 1.2502 in the second half of the day, and it is quite likely that bulls will manage to break through on the second attempt, trading will move within the framework of a new ascending channel. In this case, I will postpone sales until a false breakout at 1.2543. If there is no downward movement, I will sell GBP/USD immediately on the rebound from 1.2581, but only in anticipation of a pair correction downwards by 30-35 points within the day.

In the COT report (Commitment of Traders) for November 7, there was a reduction in both long and short positions, but this remained the same balance of power. Pound pressure was observed throughout the week, as the released report on the growth rate of the UK economy was disappointing, indicating real chances of a recession as early as the fourth quarter of this year. Considering statements by Bank of England officials about interest rates, which are expected to remain at a high level for quite a long time, the chances of a significant increase in the British pound are quite low. The only thing that can change the market balance is weak US statistics, indicating further easing price pressure. The more talk there is about interest rates in the US remaining unchanged in December of this year, the stronger the pressure on the US dollar will be and the more expensive the pound will become. The last COT report stated that long non-commercial positions decreased by 6,180 to the level of 57,532, while short non-commercial positions fell by 10,299 to the level of 73,784. As a result, the spread between long and short positions increased by 310. The weekly price increased sharply and amounted to 1.2298 against 1.2154.

Indicator Signals:

Moving Averages:

Trading is carried out above the 30 and 50-day moving averages, indicating a likelihood of pound growth.

Note: The author considers the period and prices of moving averages on the hourly chart H1 and differs from the general definition of classic daily moving averages on the daily chart D1.

Bollinger Bands:

In case of a decline, the lower boundary of the indicator, around 1.2420, will act as support.

Description of Indicators:

- Moving Average (determines the current trend by smoothing volatility and noise). Period 50. Marked on the chart in yellow.

- Moving Average (determines the current trend by smoothing volatility and noise). Period 30. Marked on the chart in green.

- MACD Indicator (Moving Average Convergence/Divergence — convergence/divergence of moving averages). Fast EMA period 12. Slow EMA period 26. SMA period 9.

- Bollinger Bands. Period 20.

- Non-commercial traders are speculators, such as individual traders, hedge funds, and large institutions using the futures market for speculative purposes and meeting certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open positions of non-commercial traders.

- The total non-commercial net position is the difference between non-commercial traders' short and long positions.