Here are the details of the economic calendar from July 14:

The United Kingdom released its inflation data yesterday, where consumer prices increased from 2.1% to 2.5% against the expected 2.3%.

The pound sterling reacted to the statistical indicators in the form of a local strengthening.

* The consumer price index is prepared by the Office of National Statistics of Great Britain, which determines the change in prices of the selected basket of goods and services for a given period. This indicator is considered a key indicator for assessing inflation. From the point of view of fundamental analysis, the growth of inflation is a positive signal for the national currency.

As for the Eurozone, there was a publication of industrial production data, which declined by 1% in May, against the forecast of 0.2%. In annual terms, a slowdown in growth rates from 39.4% to 20.5% against the forecast of 25.15 was observed. The decline is quite large, but the indicators are still not small due to the effect of the low base.

The Euro currency did not show any extraordinary reaction by the time the data was published since the quote was already following a pullback course.

* Industrial production reflects the change in production volumes at English enterprises in the reporting month compared to the same month of the previous year. The calculation of the indicator takes into account all branches of production: industry, mining, and processing of minerals, energy production, water resources, and waste management.

* The low base effect is when the growth rate of an economic indicator is explained by its extremely low starting indicator.

For the United States, the June producer price index was published, which rose from 6.6% to 7.3% against the forecast of 6.8%.

* The producer price index is prepared by the Bureau of Labor Statistics of the US Department of Labor. Their calculation includes all branches of American industry that produce physical goods, including commodity markets. In the production sector, the selling prices of producers in the mining and manufacturing industries, agriculture, construction, etc. are taken into account.

Analysis of trading charts from July 14:

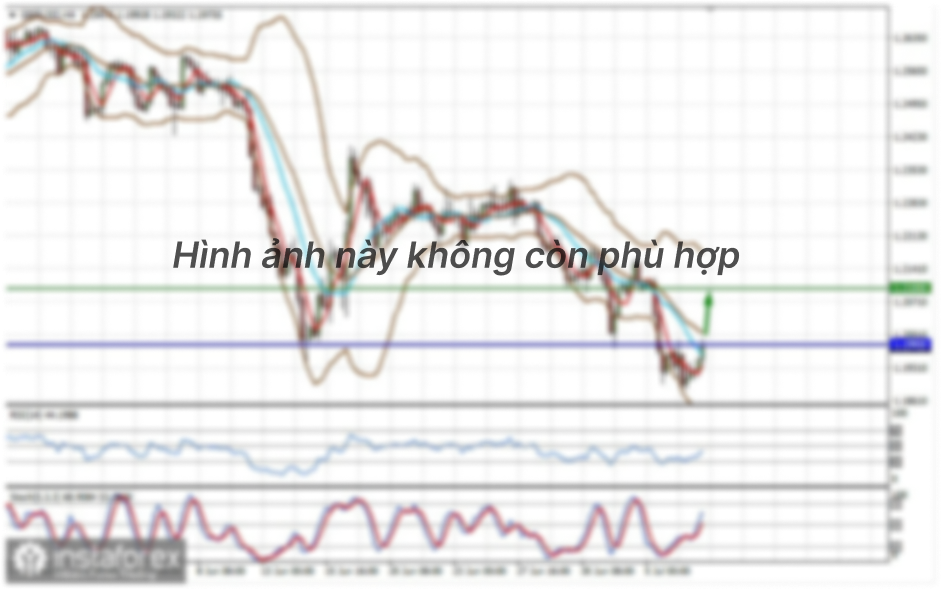

The EUR/USD pair in the pullback stage moved into a correction as if repeating the amplitude of July 8 in the market, where the support area of 1.1800 put pressure on short positions.

To simply put it, the support level of 1.1800 was falsely broken by market participants again, which resulted in a price rebound. This kind of processing of the support level also says that this coordinate has a characteristic deviation. Traders call it a range level, where a price rebound can still occur within its borders.

The trading recommendation on July 14 considered the possibility of a pullback, but the pivot point for the price movement was not so massive.

Short positions or Short means sell positions.

In our case, we were talking about reducing positions for the sale of euros.

* The support level is the so-called price level, from which the quote can slow down or stop the downward course. The principle of constructing this level is to reduce the points of support on the history of the chart, where the price reversal in the market has already occurred earlier.

The GBP/USD pair showed quite high activity in the market yesterday, during which the quote locally managed to recover from the downward movement on July 13.

Following the cycle of fluctuations, it can be seen that there is speculative interest in the market, which leads to impulse price changes up/down within a day.

The trading recommendation on July 14 considered a possible price growth but to the area of 1.3850/1.3865, which was eventually outplayed by the market.

July 15 economic calendar:

Today, the labor market in the UK has already been published. The unemployment rate was expected to remain unchanged, but in the end, there was growth from 4.7% to 4.8%.

At 12:30 Universal time, the United States will release its weekly data on applications for unemployment benefits, where a reduction in their volume is predicted.

- The volume of initial applications for benefits may decline from 373 thousand. up to 360 thousand

- The volume of repeated applications for benefits may decline from 3.339 thousand to 3 313 thousand.

* Applications for unemployment benefits reflect the number of currently unemployed citizens and those receiving unemployment benefits. This indicator is considered to be the state of the labor market, where the growth of the indicator negatively affects the level of consumption and economic growth. The reduction of applications for benefits has a positive effect on the labor market.

In other words, a decline in the number of applications for benefits can strengthen the national currency – USD.

Trading recommendation for EUR/USD on July 15, 2021

Looking at the EUR/USD trading chart, one can see an upward cycle, where the quote has already approached the resistance area of 1.1850/1.1895, which may reduce the volume of long positions.

In this case, we consider the natural basis of the past, where a reversal occurred in this price area.

Sell positions:

Traders will consider this if the price slows down in the area of 1.1850/1.1895, where the entrance to the sell positions in the direction of 1.1800-1.1770 may appear.

Buy positions:

It is already quite dangerous to consider these positions due to the fact that the resistance area has already been almost reached. In this situation, it is necessary to wait. If market participants ignore the resistance area of 1.1850/1.1895, there may be a change of trading interests, and entering the market will only happen after the price is held above the level of 1.1900 in the H4 time frame.

* The resistance level is the so-called price level, from which the quote can slow down or stop the upward movement. The principle of constructing this level is to reduce the price stop points on the history of the chart, where the price reversal in the market has already occurred earlier.

Trading recommendation for GBP/USD on July 15, 2021

As for the trading chart of the GBP/USD, a movement along with the amplitude 1.3820/1.3890 can be observed, where speculators continue to pull trading forces over each other.

To simply put it, the amplitude that took place yesterday is maintained, but its scale has fallen, which may lead to the effect of a compressed spring, where we saw compression at the start, and then acceleration.

Traders should pay special attention to the borders of the recent fluctuations of 1.3820/1.3890 since a breakdown of a particular value will indicate a subsequent speculative movement.

Sell positions:

Sell positions will be considered if the price is held above the level of 1.3820.

Buy positions:

Buy positions will be considered if the price is held above the level of 1.3900.

What is reflected in the trading charts?

A candlestick chart view is graphical rectangles of white and black light, with sticks on top and bottom. When analyzing each individual candle in detail, you will see its characteristics of a relative time period: the opening price, the closing price, the maximum and minimum prices.

Horizontal levels are price coordinates, relative to which a stop or a price reversal may occur. These levels are called support and resistance in the market.

Circles and rectangles are highlighted examples where the price of the story unfolded. This color selection indicates horizontal lines that may put pressure on the quote in the future.

The up/down arrows are the reference points of the possible price direction in the future.

Things to remember:

Golden Rule: It is necessary to figure out what you are dealing with before starting to trade with real money. Learning to trade is so important for a novice trader since the market will exist tomorrow, next week, next year, and the next decade.