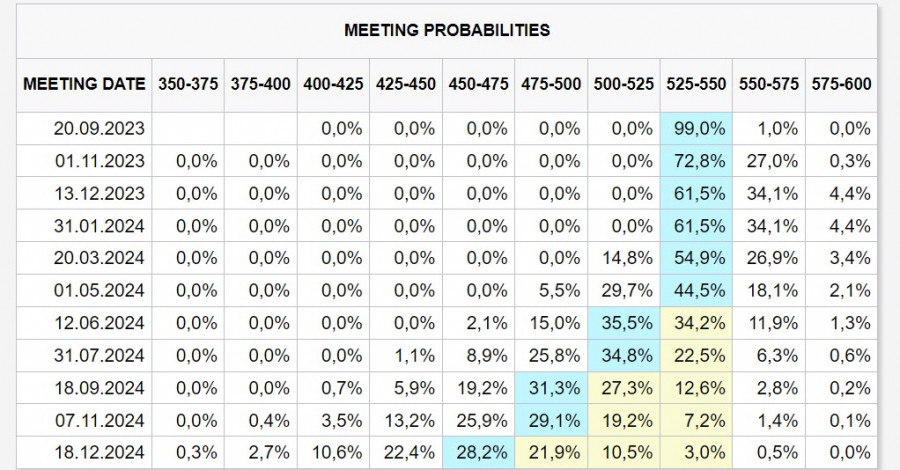

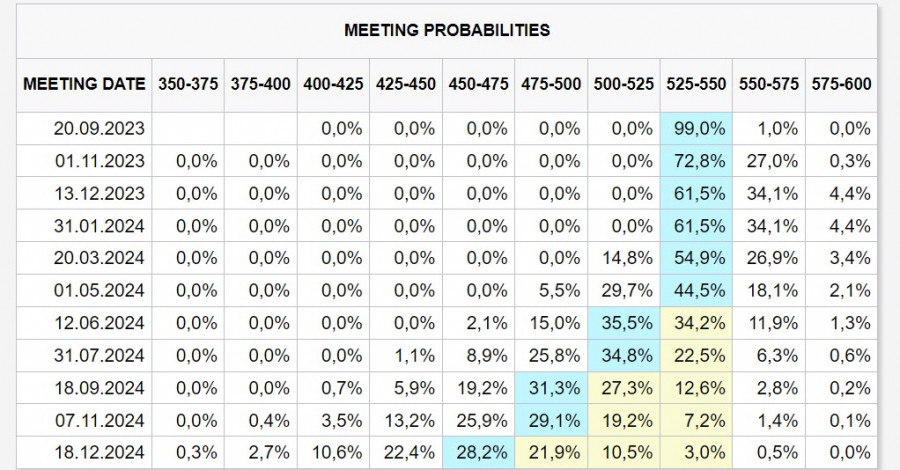

The Federal Reserve kicked off the central bank parade on Wednesday, which could trigger significant market movements. The main event is the FOMC meeting, with the Federal Reserve expected to maintain interest rates at current levels, but the main focus will be on the updated dot plot, revealing how committee members perceive the future trajectory of interest rates. Currently, there is still one possible rate hike projected for one of the upcoming meetings, which would be the final one for this cycle. However, even for this last hike, the market's forecast does not exceed 40%.

A hawkish outcome of the meeting could be considered if the Fed changes its rate forecasts in favor of one more hike this year or fewer total cuts in the next. And, of course, the spotlight will be on Fed Chairman Jerome Powell's press conference, where he will provide insights into how the U.S. central bank views the inflation trajectory. Depending on the market's interpretation, it could swing in either direction.

The rise in inflation in Canada has triggered an overall increase in yields, with 10-year U.S. Treasury bonds reaching a peak of 4.371%, the highest since 2007.

On Thursday, the Bank of England and the Swiss National Bank will hold their meetings, while European Central Bank President Christine Lagarde will deliver a speech. And on Friday morning, the Bank of Japan will conclude its meeting. A busy calendar creates the risk of sharp volatility if incoming news deviates from expectations.

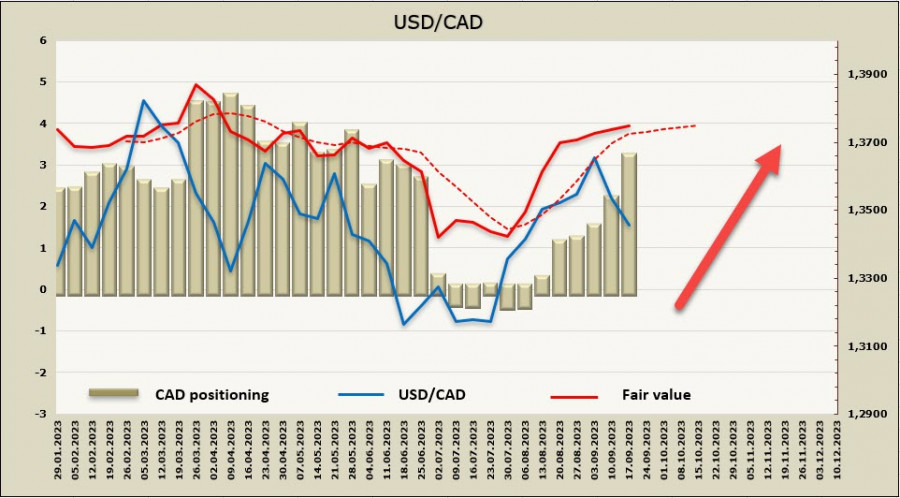

USD/CAD

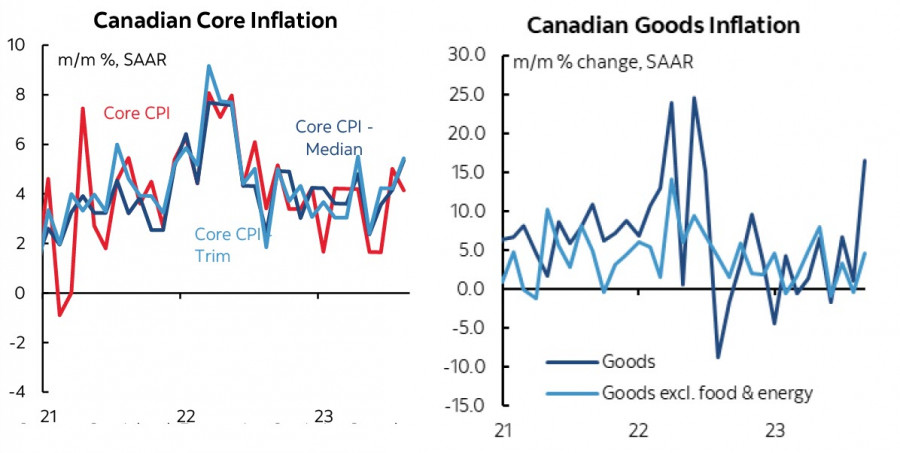

The Consumer Price Index (CPI) rose 4.0% year over year in August, following a 3.3% increase in July, exceeding forecasts. Core inflation also increased from 3.2% to 3.3%. These data refute the belief of slowing inflation in Canada, and it's not just due to rising gasoline and mortgage prices.

There is increasing evidence of rising core inflationary pressures. The weighted median and trimmed mean CPI both accelerated to 5.4% m/m at a seasonally adjusted and annualized rate. That took the three-month moving averages up to 4.4% m/m for weighted median (from 3.4%) and 4.6% for trimmed mean (from 3.6%).

Inflation in the services sector remains high but is not causing concern, unlike the goods segment, where prices soared by 16.4% m/m in August from +1% in July. There might be many explanations for such a sharp jump, but one thing is clear: the previously observed slowdown in inflation is not stable.

The inflation report certainly increases the chances that the Bank of Canada will raise rates at the October meeting, even though the meeting is scheduled for October 25, and there will be another inflation report and a series of data on employment and wages before then. Currently, one can expect a gradual shift in forecasts in favor of another rate hike, which would support the Canadian dollar.

The net short CAD position increased by 1.26 billion to -0.09 billion during the reporting week. Positioning is firmly bearish, the price is above the long-term average, and we're seeing an uptrend.

USD/CAD has just missed the support zone of 1.3330/50, where the midpoint of the channel lies. Considering that the price does not show any sign of a downward reversal, we assume that the current decline is corrective, and the Canadian dollar will resume its upward movement after forming a local base. The target is the upper band of the channel at 1.3690/3720, and then an attempt to break above the channel, with the next target at 1.3863.

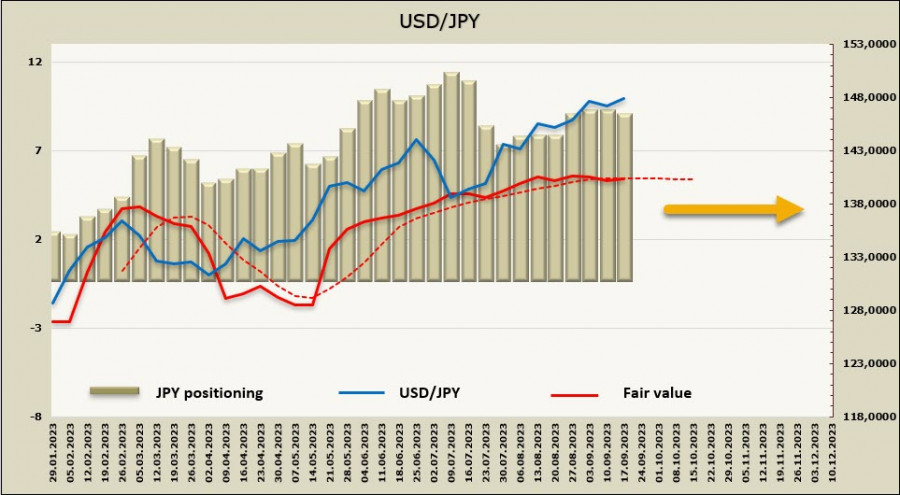

USD/JPY

The Bank of Japan will hold its monetary policy meeting on Friday morning. No changes are expected, and no new forecasts either. One of the main arguments in favor of a pass-through meeting is that the BOJ adopted greater flexibility in controlling the yield curve at its July meeting. Since that meeting, we have not received any new information that would suggest any significant change in the BOJ's views on prices and wages.

Therefore, investors will likely focus on BOJ Governor Kazuo Ueda's press conference after the meeting. He will have the opportunity to explain the Bank's views on prices and wages after the July meeting, as well as the growing market speculation about an imminent end to the negative interest rate policy.

The net short JPY position increased by 170 million to -8.389 billion over the reporting week, speculative positioning remains bearish. The price doesn't have a specific direction.

A week ago, we mentioned that the probability of a corrective decline had increased. It seems that market participants will wait for the results of the BOJ meeting to confirm whether the rhetoric about considering changes in monetary policy will be validated. Bullish sentiment on USD/JPY is gradually fading, but for a reversal or deep correction, there needs to be a foundation, which the BOJ can provide. Until that happens, trading will be in a sideways range with a slight bullish bias. Resistance is at 148.60/60, and in the event of excessively dovish comments from the BOJ, the rally could accelerate, shifting the target to the 151.91 high. However, if we confirm the Bank's intention to start changes in policy, the price may even fall to 145.00.