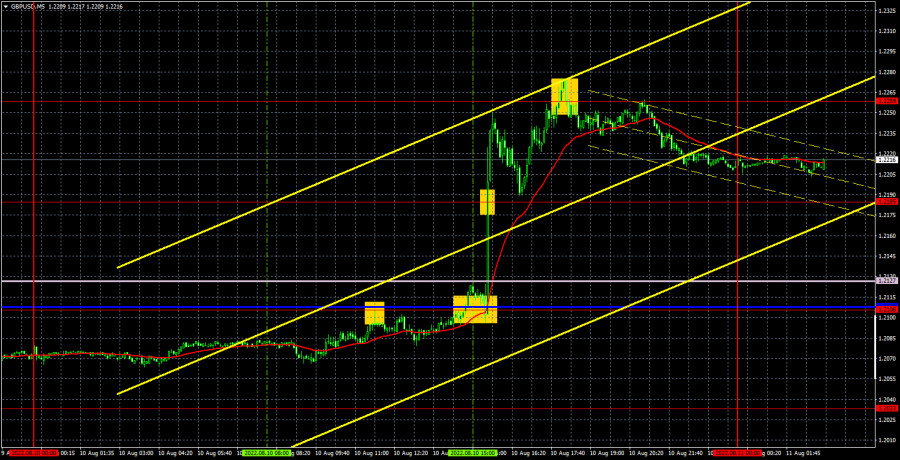

GBP/USD 5M

The GBP/USD currency pair also perked up on Wednesday and gladly showed the strongest growth during the day - more than 200 points. Naturally, such a sharp strengthening of the British currency was in fact not a strengthening of the British currency, but a fall in the US dollar. Since inflation fell to 8.5% in July (from 9.1% in June), the market quite naturally considered that now the Federal Reserve will begin to soften its aggressive approach to tighten monetary policy. Immediately, opinions began to sound from all sides about raising the Fed's rate in September by only 0.5%. From our point of view, this is not a completely logical reaction of the market, because the Fed will still tighten monetary policy for several more months, and the QT program may even work for many years. So, why is the dollar getting cheaper now? Well, it fell on one report, but then why should it go down? However, the market could change its mind about the dollar, which did nothing but grow in the last year and a half. We recommend trading very carefully in the near future, because it is not yet clear whether the global downward trend will resume or is that all?

The situation with yesterday's trading signals was very difficult. The first sell signal near the level of 1.2106 turned out to be false. It could have been closed at breakeven half an hour before the release of the US inflation report, but, most likely, it still brought a small loss to traders. The next buy signal, which was formed about half an hour before the "release of the day" - consolidating above the critical line - could formally be worked out. However, the risk associated with the inflation report was very high. Therefore, this long position was solely at the discretion of the traders. If it was open, then it should have been closed near the level of 1.2259, which brought about 130 points of profit.

COT report:

The latest Commitment of Traders (COT) report again showed insignificant changes. During the week, the non-commercial group closed 5,300 long positions and 2,900 short positions. Thus, the net position of non-commercial traders decreased by 2,400. But what does it matter, if the mood of the big players still remains "pronounced bearish", which is clearly seen in the second indicator in the chart above (purple bars below zero = bearish mood)? To be fair, in recent months, the net position of the non-commercial group is still growing and the pound also shows some tendency to grow. However, both the growth of the net position and the pound's growth are now so weak (in global terms), so it is still difficult to conclude that this is the beginning of a new upward trend. It is rather difficult to call the current growth even a "correction". We also said that the COT reports do not take into account the demand for the dollar, which is likely to remain very high right now. Therefore, to strengthen the British currency requires that the demand for it grows faster and stronger than the demand for the dollar. And on the basis of what factors is the demand for the pound growing now?

The non-commercial group currently has a total of 86,000 short positions open and only 29,000 long positions. The net position will have to show growth for a long time to at least equalize these figures. The pound can provide theoretical support through the technical need to be corrected from time to time. There is nothing more for the British currency to count on now.

We recommend to familiarize yourself with:

Overview of the EUR/USD pair. August 11. There is contact! US inflation began to slow down!

Overview of the GBP/USD pair. August 11. The British pound soared higher, but it has yet to outlast the UK GDP data.

Forecast and trading signals for EUR/USD on August 11. Detailed analysis of the movement of the pair and trading transactions.

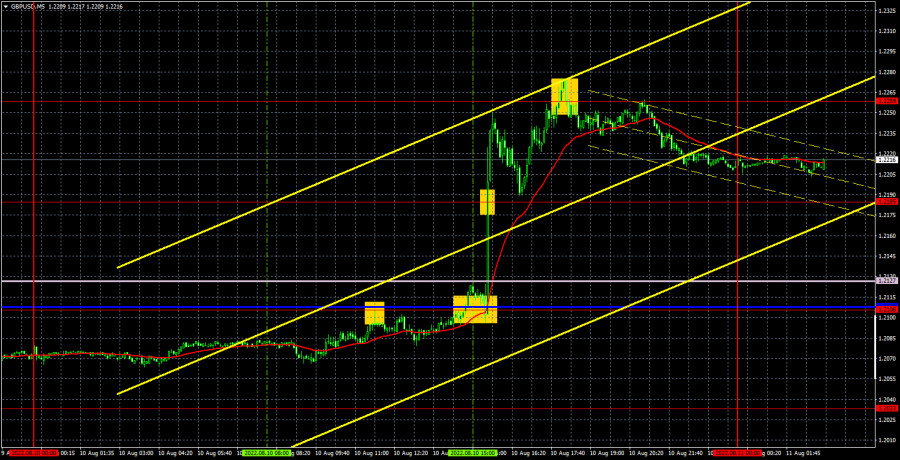

GBP/USD 1H

The pair is trying to resume the upward trend on the hourly timeframe, but a lot will now depend on the 1.2259 level or even 1.2293 level (the last local high). So far, the market has not even begun a downward correction, which indicates its readiness to continue buying the British pound. Therefore, you need to be ready for succeeding growth even without a downward correction. We highlight the following important levels on August 11: 1.2033, 1.2106, 1.2185, 1.2259, 1.2342, 1.2429. Senkou Span B (1.2127) and Kijun-sen (1.2137) lines can also be sources of signals. Signals can be "rebounds" and "breakthroughs" of these levels and lines. The Stop Loss level is recommended to be set to breakeven when the price passes in the right direction by 20 points. Ichimoku indicator lines can move during the day, which should be taken into account when determining trading signals. The chart also contains support and resistance levels that can be used to take profits on trades. No interesting events or reports scheduled in the UK on Thursday. Only the jobless claims report will be released in the US on Friday, which is unlikely to be of interest to traders.

Explanations for the chart:

Support and Resistance Levels are the levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels.

Kijun-sen and Senkou Span B lines are lines of the Ichimoku indicator transferred to the hourly timeframe from the 4-hour one.

Support and resistance areas are areas from which the price has repeatedly rebounded off.

Yellow lines are trend lines, trend channels and any other technical patterns.

Indicator 1 on the COT charts is the size of the net position of each category of traders.

Indicator 2 on the COT charts is the size of the net position for the non-commercial group.