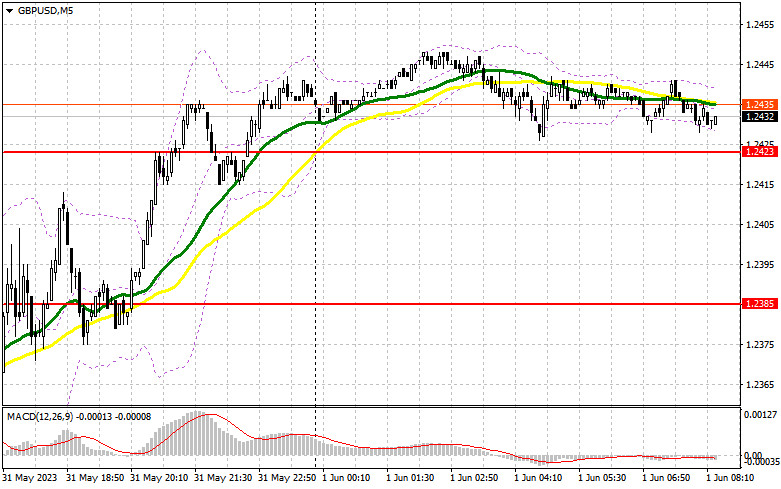

Yesterday there was only one signal to enter the market. Let's have a look at the 5-minute chart and see what happened there. In my morning review, I mentioned the level of 1.2362 as a possible entry point. A fall and false breakout through the mark produced a buy signal. Unfortunately, the pair did not rise. As a result, I got out of the market with minimal losses after breaching 1.2362 again and trading around that level. In the second half of the day, no entry signals were generated.

For long positions on GBP/USD:

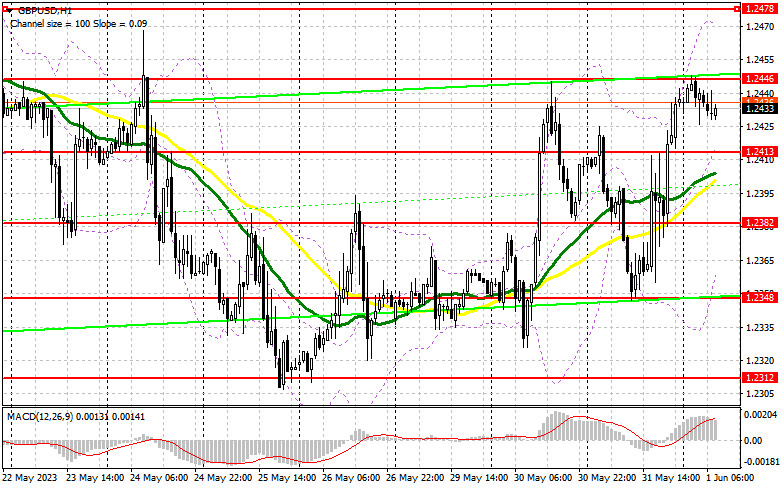

The pound managed to withstand the pressure and returned to the weekly highs after the statements of Federal Reserve officials that the US central bank could skip raising interest rates in June. This morning the focus will be on the UK Manufacturing PMI, which might disappoint traders, as well as the Net Lending to Individuals MoM, which are rather important for the economy.

Considering that I do not expect anything good from the data, I expect the pound to be under pressure and the buyers active around 1.2413. Below this mark are the bullish moving averages, so protecting this level and a false breakout would generate a great buy signal. The next target is the 1.2446 resistance, which was tested twice this week. A breakout and consolidation above this range will produce another buy signal with a pullback to 1.2478. The most distant target stands at 1.2506 where I will lock in profit.

If GBP/USD falls and there is no bullish activity at 1.2413,, the pound will face pressure, which will allow bears to win back all yesterday's growth. Therefore, it would be wiser to buy at 1.2382 after a false breakout only. I will buy GBP/USD on a rebound from 1.2348, allowing a correction of 30-35 pips intraday.

For short positions on GBP/USD:

The bulls struck quite a powerful blow to the sellers' stop-orders yesterday and now they have the chance to continue the correction. Therefore, I would expect new sellers to appear around the new resistance level of 1.2446. A failed consolidation above that range will produce a sell signal, and the pair could fall to 1.2413, a new support level, which can change the balance of forces. A break and an upside retest of this range will create a sell entry point with the target at 1.2382. The most distant target stands at 1.2348 where I will lock in profit.

If GBP/USD goes up and there is no bearish activity at 1.2446, it is better to hold back from short positions until the test of a larger resistance at 1.2478. In such a case, a false breakout through this mark will create a sell entry point. If there is no activity there either, I will sell GBP/USD at 1.2506, allowing a bearish correction of 30-35 pips intraday.

COT report:

According to the COT report for May 23, the number of long and short positions decreased. Last week, the pound was bearish. Fearing a default and a recession in the US, traders had to close positions, especially in the face of uncertainty surrounding the Bank of England's monetary policy stance. The regulator hinted at a pause in rate hikes. However, with high inflationary pressures in the UK, it seems unlikely. The COT report showed that non-commercial short positions dropped by 7,181 to 57,614, and non-commercial long positions fell by 8,185 to 69,203. The overall non-commercial net position came in at 11,059 versus 12,593 a week earlier. The weekly closing price fell to 1.2425 from 1.2495.

Indicator signals:

Moving Averages

Trading is carried out above the 30-day and 50-day moving averages, which indicates that the pound will continue to rise.

Please note that the time period and levels of the moving averages are analyzed only for the H1 chart, which differs from the general definition of the classic daily moving averages on the D1 chart.

Bollinger Bands

If the pair falls, the lower band of the indicator at 1.2365 will act as support.

Description of indicators:

• A moving average of a 50-day period determines the current trend by smoothing volatility and noise; marked in yellow on the chart;

• A moving average of a 30-day period determines the current trend by smoothing volatility and noise; marked in green on the chart;

• MACD Indicator (Moving Average Convergence/Divergence) Fast EMA with a 12-day period; Slow EMA with a 26-day period. SMA with a 9-day period;

• Bollinger Bands: 20-day period;

• Non-commercial traders are speculators such as individual traders, hedge funds, and large institutions who use the futures market for speculative purposes and meet certain requirements;

• Long non-commercial positions represent the total number of long positions opened by non-commercial traders;

• Short non-commercial positions represent the total number of short positions opened by non-commercial traders;

• The non-commercial net position is the difference between short and long positions of non-commercial traders.