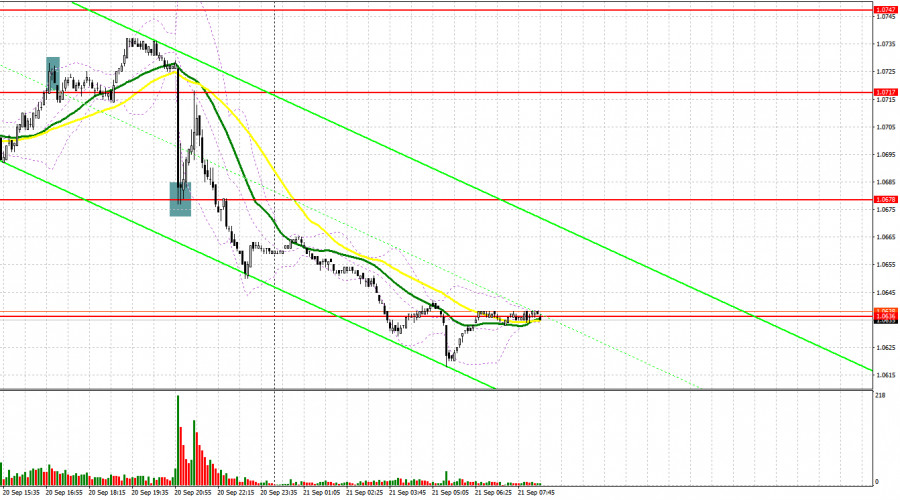

Yesterday, the pair formed several entry signals. Let's see what happened on the 5-minute chart. In my morning review, I mentioned the level of 1.0688 as a possible entry point. A rise and a false breakout at this mark generated a sell signal, but after falling by 10 pips, the demand for risky assets returned. In the afternoon, a false breakout at 1.0717 and the sell signal did not lead to any result, which cannot be said about the defense and long positions in the area of 1.0678. As a result, the pair rose by more than 30 pips.

For long positions on EUR/USD:

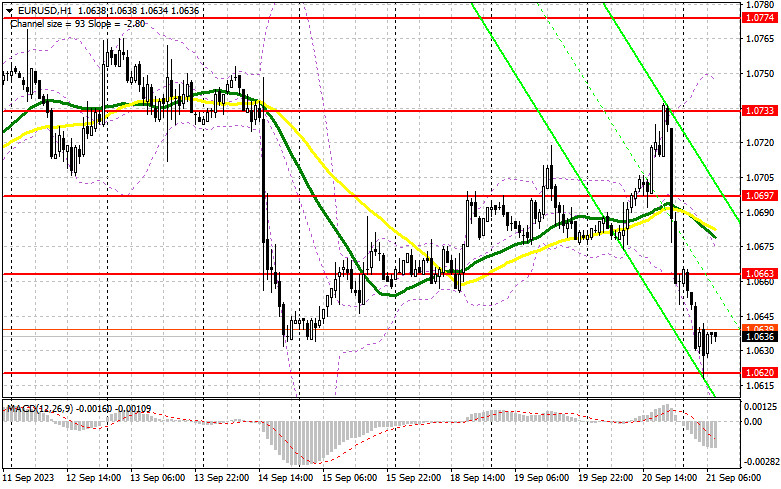

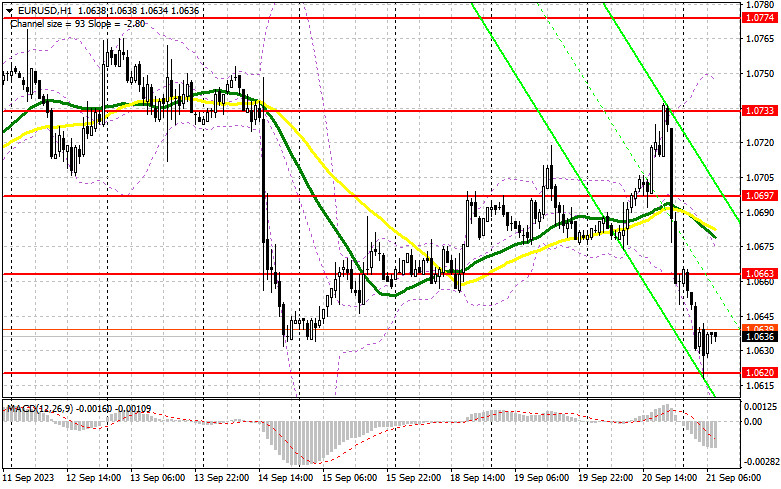

Yesterday, the Federal Reserve left rates unchanged while revising inflation forecasts, which boosted the dollar. Policymakers have also made it clear that rates at current highs will remain unchanged for much longer than previously forecast, and that inflation will return to the target level no earlier than 2026. The number of interest rate cuts in 2024 has also been downwardly revised. This morning brings the release of the eurozone consumer confidence indicator, as well as a speech by European Central Bank President Christine Lagarde, but we don't expect to hear anything new from her, although her colleagues have recently hinted at the fact that eurozone borrowing costs had peaked. I plan to act on a dip in EUR/USD after it forms a false breakout around the nearest support at 1.0620. This will offer a chance for a correction and the target in sight is the resistance at 1.0663. A breakout and a downward test of this level, in the absence of influential eurozone data, will boost demand for the euro, offering a chance for a surge to 1.0697. Below this level, we have the moving averages that favor the sellers. The ultimate target would be the 1.0733 area, where I intend to lock in profits. If EUR/USD declines and there is no activity at 1.0620, the bearish trend will persist. Only the formation of a false breakout near 1.0590 will give a signal to buy the euro. I will open long positions immediately on the rebound from 1.0554, aiming for an upward correction of 30-35 points within the day.

For short positions on EUR/USD:

Sellers continue to dominate the market, which they proved yesterday afternoon after the Fed announced its new forecasts. All they need to focus on is defending the level of the nearest resistance at 1.0663. Just above this level, the moving averages favor the bears. A false breakout at this level will give a sell signal paving the way towards 1.0620. Only after breaching this range and settling below it, and after completing an upward retest, do I anticipate another sell signal with a target at 1.0590 - a new monthly low, where I expect significant buyer activity. The furthest target is the 1.0554 area, where I plan to take profit. If EUR/USD rises and there is no activity at 1.0663, buyers will get a chance for a correction. In such a scenario, I will refrain from going short until the price hits the new resistance at 1.0697. You can sell here as well but only after a failed consolidation. I will open short positions immediately on the rebound from the 1.0733 high, aiming for a downward correction of 30-35 points.

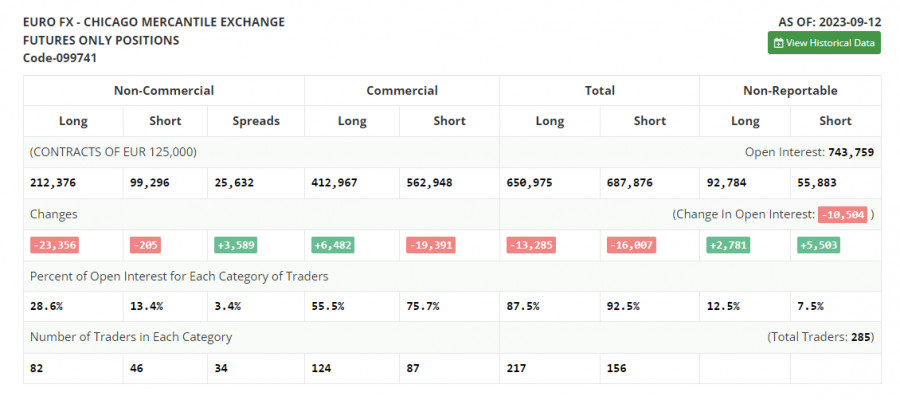

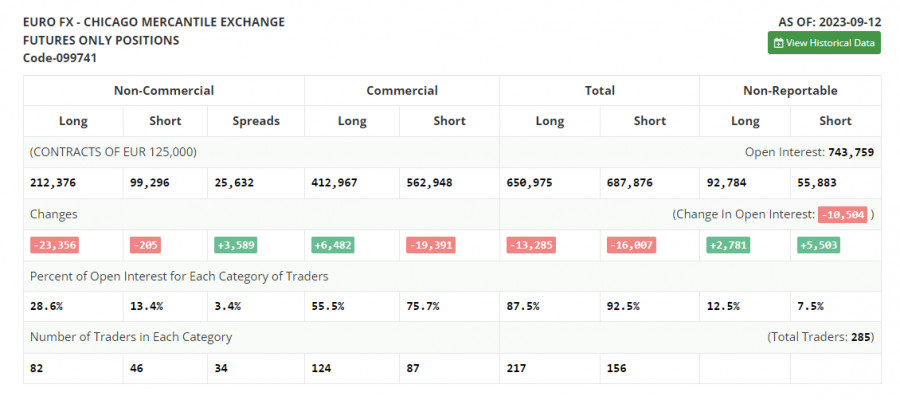

COT report:

The COT report for September 12 revealed a sharp drop in long positions and a modest decline in the long ones. This decline can be attributed to some significant negative developments in the Eurozone economy and a downward revision of the GDP for the second quarter. Despite these setbacks, the European Central Bank (ECB) made a decision to hike interest rates. Such a move in the given scenario could have unfavorable implications in the near term and it might have triggered a sharp depreciation of the European currency. In the coming days, all eyes will be on the Federal Reserve's meeting. Should the committee also decide to increase rates, the euro could face further declines against the dollar. Therefore, it would be wise to exercise caution before making any purchases in the current environment. The COT report indicates a drop in non-commercial long positions by 23,356 to 212,376. On the other hand, non-commercial short positions saw a minor decrease of 205, standing at 99,296. Consequently, the spread between long and short positions expanded by 6,589. The closing price fell to 1.0736 compared to the previous value of 1.0728, signaling a bearish market trend.

Indicator signals:

Moving Averages

Trading below the 30- and 50-day moving averages indicates a further decline in the pair.

Please note that the time period and levels of the moving averages are analyzed only for the H1 chart, which differs from the general definition of the classic daily moving averages on the D1 chart.

Bollinger Bands

If the pair declines, the lower band of the indicator near 1.0590 will act as support.

Description of indicators:

• A moving average of a 50-day period determines the current trend by smoothing volatility and noise; marked in yellow on the chart;

• A moving average of a 30-day period determines the current trend by smoothing volatility and noise; marked in green on the chart;

• MACD Indicator (Moving Average Convergence/Divergence) Fast EMA with a 12-day period; Slow EMA with a 26-day period. SMA with a 9-day period;

• Bollinger Bands: 20-day period;

• Non-commercial traders are speculators such as individual traders, hedge funds, and large institutions who use the futures market for speculative purposes and meet certain requirements;

• Long non-commercial positions represent the total number of long positions opened by non-commercial traders;

• Short non-commercial positions represent the total number of short positions opened by non-commercial traders;

• The non-commercial net position is the difference between short and long positions of non-commercial traders.