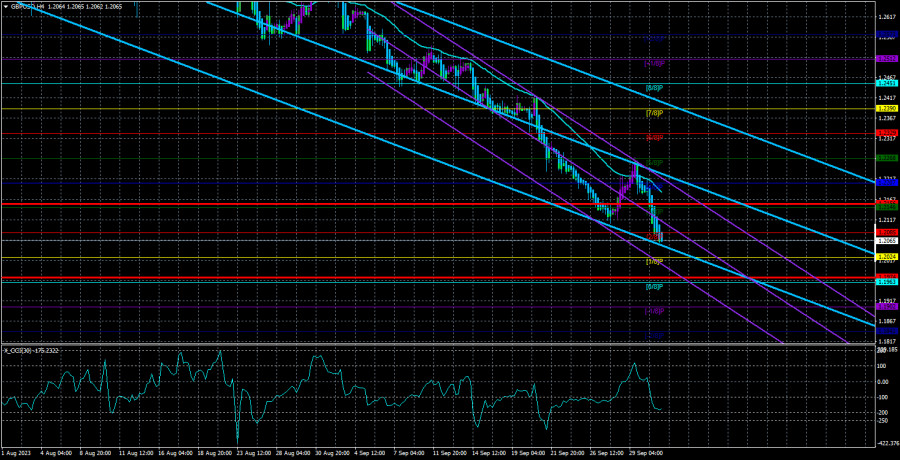

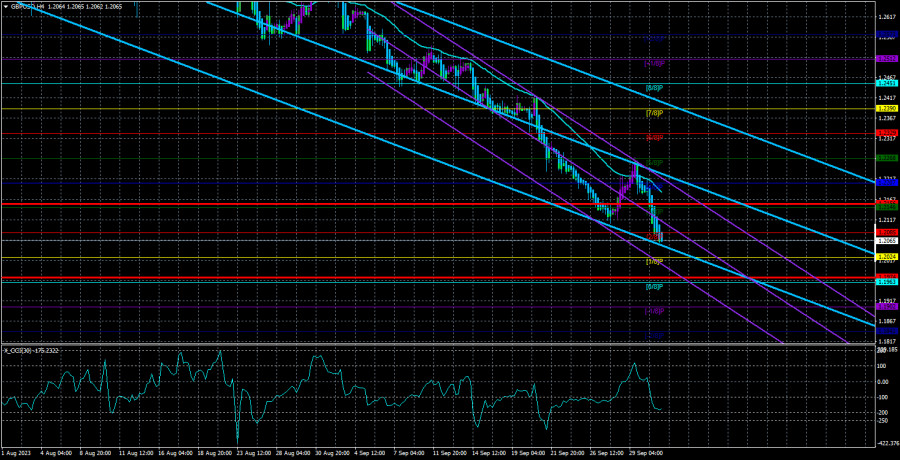

The GBP/USD currency pair resumed its downward movement sharply and significantly on Monday. As we have mentioned in previous articles, the most logical phrase would be "resumed upward movement," but the correction turned out to be very weak, although the breakout of the moving average did occur. However, this breakout only confused traders. Many were expecting a 300–400 point correction after two months of decline, but what they got was a movement of only 150 points. Moreover, if there were substantial reasons for the strengthening of the American currency yesterday. But no, the macroeconomic statistics were ordinary and routine and did not imply a 100-point strengthening of the dollar. Therefore, we can only conclude that we are witnessing an inertia-driven decline in the British currency. We do not consider it illogical because the pound has risen by almost 3000 points in the last 12 months. First, a correction is needed, and second, the pound has risen illogically for a long time, so a "rebalancing of fairness" is required. And that's what we are observing now.

The Business Activity Index in the manufacturing sector of the UK in the second estimate for September certainly could not have been the reason why the pair plummeted on Monday. After all, the day started relatively positively for it, with an uptrend. But everything changed in just 5 minutes, and the reasons are unclear. It seems that in the medium term, the decline remains much more expected and likely, but the correction turned out to be very weak.

There are no changes to the 24-hour TF. The pair continues its confident movement towards the Fibonacci level of 38.2% (1.1839), and there are only 200 points left to reach it. We do not exclude that the British pound may show an even more significant decline in the near future, but we should still remember about fairness: there are no reasons or grounds for a drop below 1.1840.

Will nonfarm payrolls have any significance for the dollar? In the UK this week, the Business Activity Index in the manufacturing sector has already been released, as mentioned earlier. On Tuesday, the UK event calendar is empty, and on Wednesday, the Business Activity Index in the services sector for September will be released in the second estimate. Thursday will bring the Business Activity Index in the construction sector, and Friday will have nothing. It can be said that there won't be anything interesting happening in the UK this week.

But there will be plenty of interesting events in the US this week. The first week of every month is the time for the release of labor market and unemployment data, which remain very important for both the dollar and the Federal Reserve. Many experts still believe that the US will face a recession next year, so the deterioration of key macroeconomic indicators will confirm this hypothesis. And what indicators can be more important than nonfarm payrolls, unemployment, and ISM indices?

On Monday, the ISM index in the manufacturing sector was already released, and it turned out to be better than expected. On Tuesday, the JOLTs report on the number of job openings will be released. On Wednesday, the ADP report on changes in non-farm employment and the ISM index in the services sector will be published. On Thursday, there will be jobless claims. On Friday, we will see nonfarm payrolls, unemployment, and wages. As we can see, all the most important publications are scheduled in the United States.

The average volatility of the GBP/USD pair over the last 5 trading days as of October 3rd is 91 pips. For the pound/dollar pair, this value is considered "average." As a result, on Tuesday, October 3rd, we anticipate movement within the range between 1.1974 and 1.2156. An upward reversal of the Heiken Ashi indicator will signal a new phase of upward correction.

Nearest support levels:

S1 - 1.2024

S2 - 1.1963

S3 - 1.1902

Nearest resistance levels:

R1 - 1.2085

R2 - 1.2146

R3 - 1.2207

Trading Recommendations:

The GBP/USD pair on the 4-hour timeframe has resumed its downward movement and continues to update its lows. Therefore, at the moment, it is advisable to stay in short positions with targets at 1.2024 and 1.1974 until the price consolidates above the moving average. Long positions can be done no earlier than after the price consolidates above the moving average line, with targets at 1.2207 and 1.2268.

Explanations for the illustrations:

Linear regression channels - help determine the current trend. If both are pointing in the same direction, it means the trend is currently strong.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the probable price channel in which the pair will trade over the next day, based on current volatility indicators.

CCI indicator - its entry into the overbought area (above +250) or oversold area (below -250) indicates that a trend reversal in the opposite direction is approaching.