Analysis of Friday's Trades

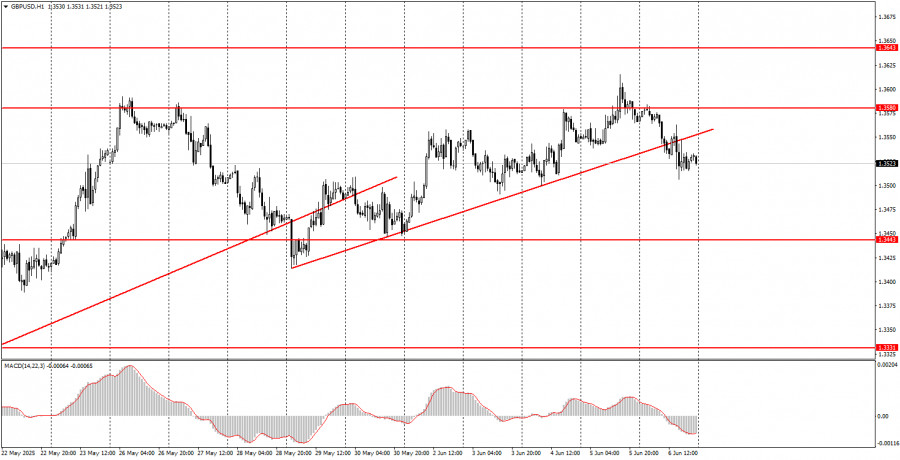

1H Chart of GBP/USD

The GBP/USD pair also traded lower on Friday for the same reasons as the EUR/USD pair. The dollar received minimal market support due to decent macroeconomic data from across the ocean, but this growth does not open any new prospects. Unfortunately, the U.S. currency remains under the pressure of Donald Trump's trade policy, and the market has a clear aversion to the dollar. Few are willing to risk investing in the dollar or the American economy amid the complete economic uncertainty, which all Federal Reserve's Monetary Committee members are now openly acknowledging. From a technical standpoint, the price has consolidated below the new ascending trendline, but even this fact means absolutely nothing. If, on Monday, Trump gets caught up in another scandal or raises tariffs again, the U.S. dollar will quickly and vigorously resume its decline despite consolidating below the trendline. Unfortunately, the "Trump factor" remains in force and is impossible to predict.

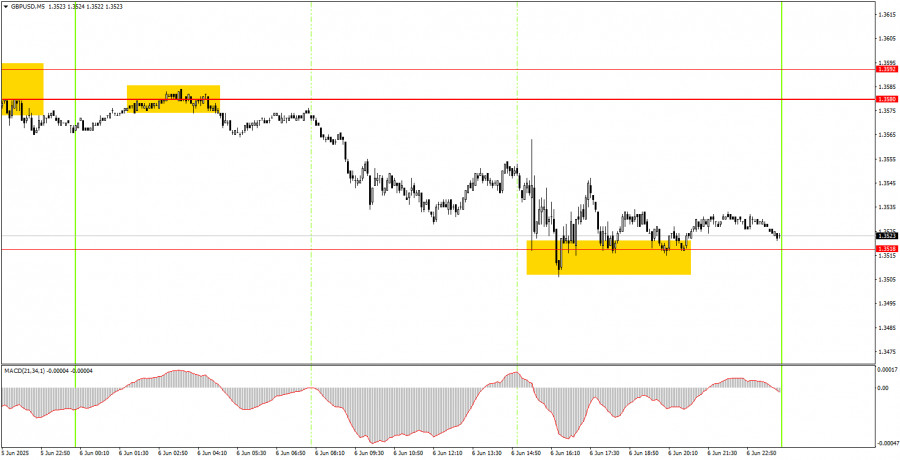

5M Chart of GBP/USD

Two trading signals were formed in the 5-minute timeframe on Friday. During the Asian session, the price rebounded from the 1.3580–1.3592 area, but by the opening of the European session, the price had barely moved away from the signal formation point. Therefore, sell trades could be opened confidently. The nearest target level of 1.3518 was reached during the American session, where profits could be taken. Formally, a buy signal formed around this level, but selling the dollar on decent U.S. data was hardly advisable.

Trading Strategy for Monday:

In the hourly timeframe, the GBP/USD pair reacts mainly to Trump and remains quite skeptical of his policies. There are signs of reduced trade tension, but the market does not feel a wave of optimism, and there are far more signs of renewed escalation. Therefore, as before, the market uses any opportunity to sell the dollar rather than buy it. This will continue until the market sees real signs of the end of the trade war.

On Monday, the GBP/USD pair may continue a slight downward movement if Trump does not again interfere with the dollar's strengthening.

On the 5-minute timeframe, the levels to trade are: 1.3043, 1.3102–1.3107, 1.3203–1.3211, 1.3259, 1.3329–1.3331, 1.3421–1.3443, 1.3518, 1.3580–1.3592, 1.3652–1.3660, 1.3695. On Monday, no significant events or reports are scheduled in the U.S. or the UK, so trading will primarily rely on technical signals. If Trump does not take the stage again, we will likely see low volatility and movements close to flat.

Core Trading System Rules:

- Signal Strength: The shorter the time it takes for a signal to form (a rebound or breakout), the stronger the signal.

- False Signals: If two or more trades near a level result in false signals, subsequent signals from that level should be ignored.

- Flat Markets: In flat conditions, pairs may generate many false signals or none at all. It's better to stop trading at the first signs of a flat market.

- Trading Hours: Open trades between the start of the European session and the middle of the US session, then manually close all trades.

- MACD Signals: On the hourly timeframe, trade MACD signals only during periods of good volatility and a clear trend confirmed by trendlines or trend channels.

- Close Levels: If two levels are too close (5–20 pips apart), treat them as a support or resistance zone.

- Stop Loss: Set a Stop Loss to breakeven after the price moves 20 pips in the desired direction.

Key Chart Elements:

Support and Resistance Levels: These are target levels for opening or closing positions and can also serve as points for placing Take Profit orders.

Red Lines: Channels or trendlines indicating the current trend and the preferred direction for trading.

MACD Indicator (14,22,3): A histogram and signal line used as a supplementary source of trading signals.

Important Events and Reports: Found in the economic calendar, these can heavily influence price movements. Exercise caution or exit the market during their release to avoid sharp reversals.

Forex trading beginners should remember that not every trade will be profitable. Developing a clear strategy and practicing proper money management are essential for long-term trading success.