The GBP/USD currency pair continued its upward movement on Thursday and nearly updated its three-year high. For most of the day, quotes hovered around the 1.36 level, and we do not doubt that this level won't hold back buyers for long. Everything stated in the EUR/USD article also applies to GBP/USD — and to all pairs involving the U.S. dollar. Remember: it's not the pound or euro that is rising — it's the dollar that is consistently falling. Without the "Trump factor," we likely wouldn't see any growth. Like the euro, the British pound had been preparing for a long-term decline in January following a strong correction, but Donald Trump flipped the entire FX market upside down.

We believe that there is nothing to hope for. One must understand that Trump will, one way or another, tighten trade rules with the U.S. to maximize profit and benefit — not personally, but for the U.S. budget. At least, that's Trump's perspective. Many experts, however, do not forecast any positive effects for the American economy — even if minimum tariff rates remain in effect. Experts also point to Trump's tax legislation, which was introduced as a tax-cut bill but is, in reality, a massive document that touches on many important issues. Experts agree this bill will add another $3 trillion to the national debt. Let's not forget that Trump originally aimed to reduce the national debt and shrink the budget deficit.

Not long ago, there were hopes that the courts might stop Trump. Twelve Democratic governors filed a lawsuit against the Republican leader in the International Trade Court, arguing that the president violated the law by unilaterally imposing global tariffs. The court initially sided with the plaintiffs and overturned the tariffs. But the very next day, the Appellate Court reversed the decision.

This legal back-and-forth doesn't stem from "loopholes" but rather from the sheer number of overlapping laws. In U.S. legislation, if one tries hard enough, permission can be found for nearly any action under "certain circumstances." For example, Trump himself said he could deploy the regular army to disperse protests against him and his immigration policies. And yes — there's a law that allows the military to act against U.S. citizens: the "Insurrection Act." After all, what's a protest, if not an "insurrection"?

Those "certain circumstances" are often described so vaguely that they can be applied to just about anything. For example, if a dog attacks Trump near the White House, couldn't that be interpreted as a "canine uprising"? That's why we're confident that all tariffs will remain in effect until Trump personally decides to lower or cancel them. And as for when that might happen — it's anyone's guess.

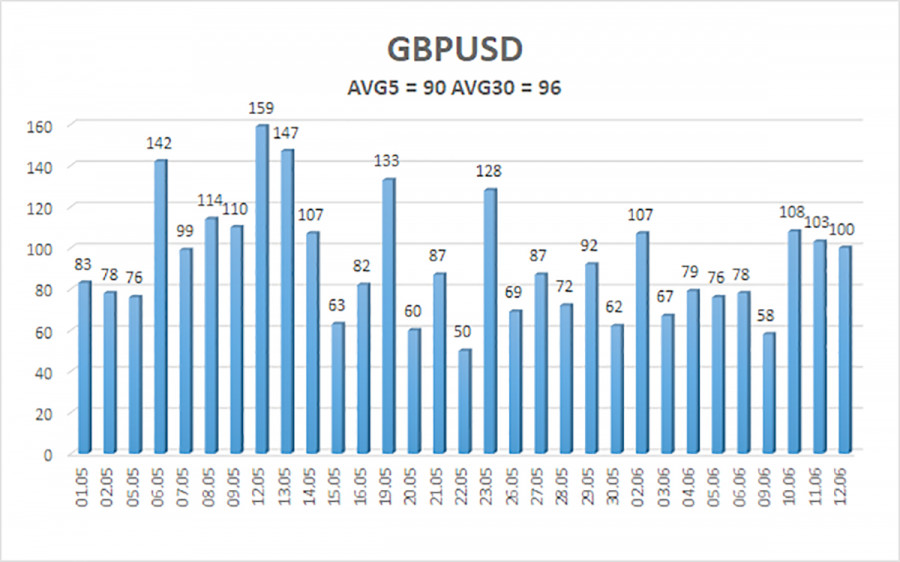

The average volatility of the GBP/USD pair over the last five trading days is 90 pips, which is classified as "moderate." On Friday, June 13, we expect the pair to trade within the 1.3493–1.3673 range. The long-term regression channel is pointed upward, indicating a clear bullish trend. The CCI indicator has not entered extreme zones recently.

Nearest Support Levels:

S1 – 1.3550

S2 – 1.3489

S3 – 1.3428

Nearest Resistance Levels:

R1 – 1.3611

R2 – 1.3672

R3 – 1.3733

Trading Recommendations:

The GBP/USD pair maintains its upward trend and continues to grow. There is no shortage of news supporting this movement. The market perceives each new decision from Trump negatively, and there's very little positive news coming from the U.S. Therefore, long positions targeting 1.3672 and 1.3733 are much more relevant when the price is above the moving average than short positions. A break below the moving average allows short positions toward 1.3489 and 1.3428, but the probability of growth remains significantly higher. The U.S. dollar may show occasional corrections, but sustained growth would require concrete signs of ending the global trade war.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.