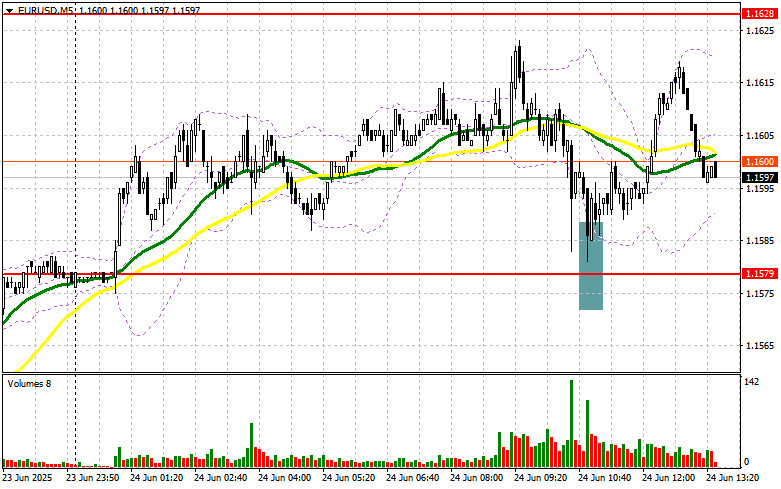

In my morning forecast, I highlighted the 1.1579 level and planned to use it for making entry decisions. Let's look at the 5-minute chart and see what happened. The decline and the formation of a false breakout at that level provided a good buying opportunity for the euro, continuing yesterday's bullish trend, resulting in a 30-point rise. The technical outlook remained unchanged for the second half of the day.

To open long positions on EUR/USD:

Mixed IFO data from Germany limited the upward potential of the EUR/USD pair but did not apply significant pressure to the market. In the second half of the day, we expect the U.S. Consumer Confidence Index, along with an important speech by Federal Reserve Chair Jerome Powell, who will attempt to explain to U.S. policymakers why he is not cutting interest rates.

If the euro declines again after the data, I will act around the support level of 1.1579. A false breakout there — similar to the one discussed above — will serve as a signal to buy EUR/USD in anticipation of a recovery and a retest of resistance at 1.1628, which was not reached in the first half of the day. A breakout and retest of this range will confirm a proper entry point with a move toward the 1.1666 level. The final target will be 1.1699, where I plan to take profit.

If EUR/USD falls and there is no activity near 1.1579, pressure on the pair will increase, potentially triggering a larger decline. In that case, the bears may push the pair to 1.1542. Only after a false breakout form there do I plan to buy euros. I will consider opening long positions on a direct rebound only from 1.1498, aiming for a 30–35 point intraday correction.

To open short positions on EUR/USD:

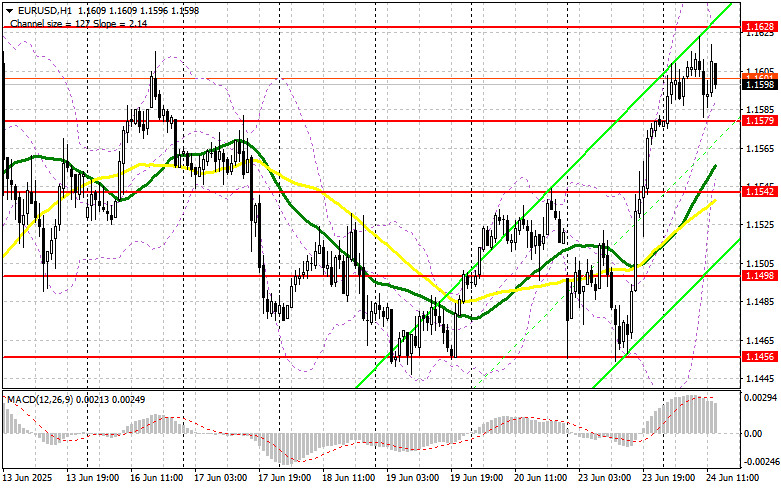

Sellers attempted to pressure the market in the first half of the day, but the outcome was weak. The scenario for further euro growth remains intact, but this will require weak U.S. data. A false breakout around 1.1628 will be a signal for short positions, targeting a drop to support at 1.1579. A breakout and consolidation below this range would be an ideal sell setup, with a move toward 1.1542, where moving averages — currently favoring the bulls — are located. The final target will be the 1.1498 level, where I will take profit.

If EUR/USD continues rising in the second half of the day and bears show no action near 1.1628, buyers may succeed in building a new bullish trend and pushing the pair toward 1.1666. I will consider selling only after a failed consolidation above that level. I will open short positions on a direct rebound only from 1.1699, targeting a 30–35 point correction.

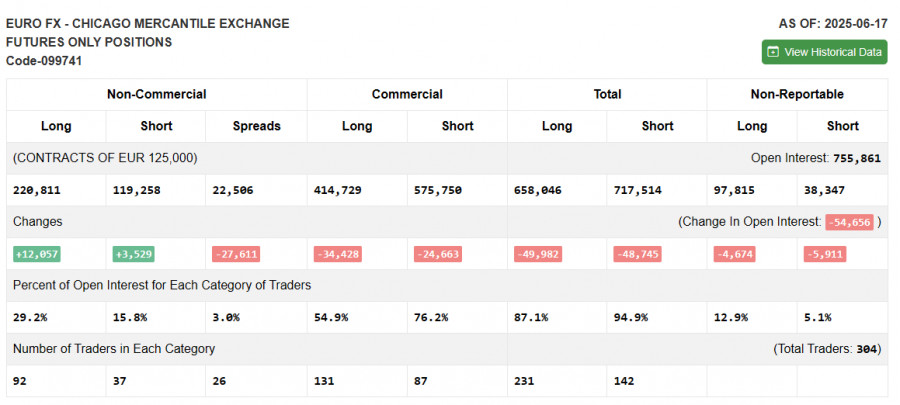

COT Report (Commitment of Traders) – June 17:

The report showed increases in both long and short positions. The Fed's decision to leave interest rates unchanged positively impacted the U.S. dollar's positioning, though the main growth driver remained the Middle East conflict. Upcoming data on U.S. economic growth may influence the Fed's plans — and, consequently, the future direction of EUR/USD.

The COT report showed that non-commercial long positions rose by 12,057 to 220,811, while short positions increased by 3,529 to 119,258. As a result, the gap between long and short positions narrowed by 27,611.

Indicator Signals:

Moving AveragesTrading is taking place above the 30- and 50-period moving averages, indicating continued euro strength.Note: The author uses the H1 hourly chart for these moving averages, which differ from the classic daily moving averages on the D1 chart.

Bollinger Bands In case of a decline, the lower band around 1.1542 will act as support.

Indicator Descriptions:

- Moving Average – Determines the current trend by smoothing out volatility and noise.

- 50-period, marked in yellow on the chart

- 30-period, marked in green on the chart

- MACD (Moving Average Convergence/Divergence)

- Fast EMA – 12-period

- Slow EMA – 26-period

- Signal line (SMA) – 9-period

- Bollinger Bands – 20-period

- Non-commercial traders – Speculators such as individual traders, hedge funds, and large institutions using the futures market for speculative purposes under certain regulatory definitions

- Long non-commercial positions – Total long open positions held by non-commercial traders

- Short non-commercial positions – Total short open positions held by non-commercial traders

- Net non-commercial position – The difference between short and long positions held by non-commercial traders