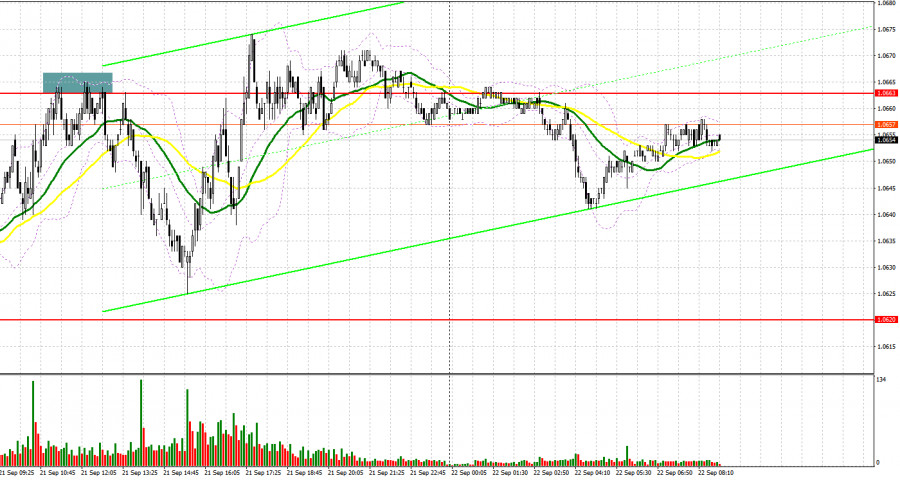

Yesterday, the pair formed only one signal to enter the market. Let's have a look at what happened on the 5-minute chart. In my morning review, I mentioned the level of 1.0663 as a possible entry point. A rise to this level and its false breakout served as a signal to sell the euro and sent it down by more than 40 pips. In the afternoon, no good entry signals were formed.

For long positions on EUR/USD:

A decrease in US unemployment claims has resulted in another strengthening of the US dollar on Thursday in the second part of the day. However, the pair couldn't surpass its monthly lows. It appears that sellers might repeat this attempt today. The reason for a potential further decline in the pair would be data related to the Eurozone's manufacturing PMI, services sector PMI, and composite PMI. We expect weak indicators across the board, signaling reduced activity, which is concerning for the prospects of the European currency and economy. Consequently, I plan to act against the bearish trend only when the pair dips around the nearest support at 1.0645. A false breakout there will provide a favorable entry point for long positions, anticipating a bullish correction towards the end of the week with a target at the resistance of 1.0672. A successful break and subsequent top-down test of this range, given positive Eurozone macroeconomic indicators, will stimulate demand for the euro, providing an opportunity for a leap to 1.0704. The ultimate target would be the 1.0734 area, where I will lock in profits. If EUR/USD continues its descent and no activity manifests around 1.0645 (which seems probable), the bearish trend will prevail. Only a false breakout around 1.6020 will serve as a market entry signal. I will open long positions on a rebound immediately from 1.0590, aiming for a bullish correction of 30-35 pips within the day.

For short positions on EUR/USD:

Sellers remain in control despite a minor correction observed yesterday afternoon. Evidently, to develop a new bearish trend, sellers need unfavorable statistics from the Eurozone and strong resistance at 1.0672, just below which moving averages are found. A false breakout at this level will serve as a great entry point for short positions, with a target to descend to the interim support at 1.0645. Only after breaking below and settling beneath this range, followed by a bottom-up retest, do I anticipate another sell signal with targets at 1.0620 and 1.0590 — the new monthly low, where substantial buyers are expected to emerge. The furthest target would be the 1.0554 area, where I will lock in profits. If the EUR/USD rises during the European session and bears are absent at 1.0672, buyers might have a favorable opportunity to recover by the week's end. In such a scenario, I will postpone selling the pair until the price hits the new resistance at 1.0704. I would consider selling there, but only after a failed consolidation. I will open short positions immediately on a rebound from the 1.0734 high, targeting a bearish correction of 30-35 pips.

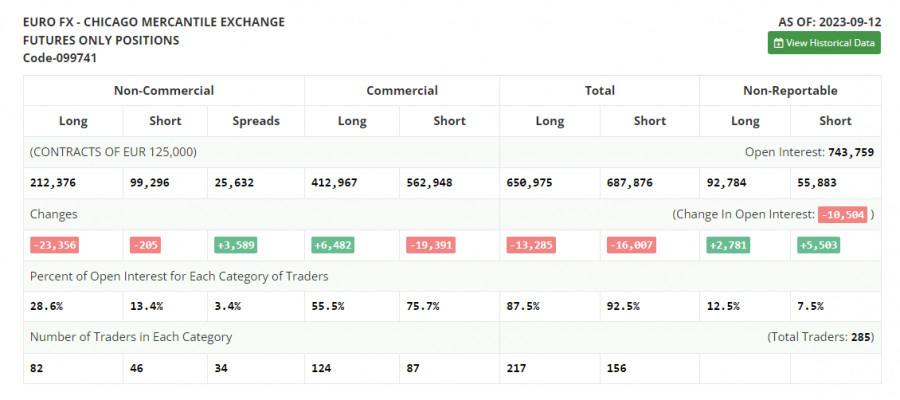

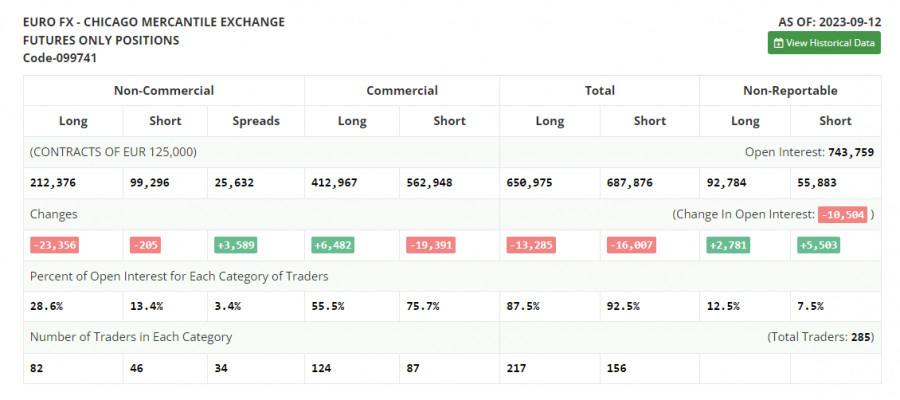

COT report

The Commitments of Traders report for September 12 revealed a sharp drop in long positions and a modest decline in the long ones. This decline can be attributed to some significant negative developments in the Eurozone economy and a downward revision of the GDP for the second quarter. Despite these setbacks, the European Central Bank (ECB) made a decision to hike interest rates. Such a move in the given scenario could have unfavorable implications in the near term and it might have triggered a sharp depreciation of the European currency. In the coming days, all eyes will be on the Federal Reserve's meeting. Should the committee also decide to increase rates, the euro could face further declines against the dollar. Therefore, it would be wise to exercise caution before making any purchases in the current environment. The COT report indicates a drop in non-commercial long positions by 23,356 to 212,376. On the other hand, non-commercial short positions saw a minor decrease of 205, standing at 99,296. Consequently, the spread between long and short positions expanded by 6,589. The closing price fell to 1.0736 compared to the previous value of 1.0728, signaling a bearish market trend.

Indicator signals:

Moving Averages

Trading below the 30- and 50-day moving averages indicates a further decline in the pair.

Please note that the time period and levels of the moving averages are analyzed only for the H1 chart, which differs from the general definition of the classic daily moving averages on the D1 chart.

Bollinger Bands

If the pair declines, the lower band of the indicator at 1.0640 will act as support.

Description of indicators:

• A moving average of a 50-day period determines the current trend by smoothing volatility and noise; marked in yellow on the chart;

• A moving average of a 30-day period determines the current trend by smoothing volatility and noise; marked in green on the chart;

• MACD Indicator (Moving Average Convergence/Divergence) Fast EMA with a 12-day period; Slow EMA with a 26-day period. SMA with a 9-day period;

• Bollinger Bands: 20-day period;

• Non-commercial traders are speculators such as individual traders, hedge funds, and large institutions who use the futures market for speculative purposes and meet certain requirements;

• Long non-commercial positions represent the total number of long positions opened by non-commercial traders;

• Short non-commercial positions represent the total number of short positions opened by non-commercial traders;

• The non-commercial net position is the difference between short and long positions of non-commercial traders.