The EUR/USD currency pair resumed its downward movement during Monday and surpassed the last local minimum, which was around the Murray level "2/8" (1.0498). Thus, the decline of the European currency (which we expected and predicted) resumed much faster than one could imagine. We anticipated a much stronger corrective movement, but the market decided otherwise once again. Recall that in the first half of this year, there were many questions about the rise of the European currency. While the euro did not always rise, it consistently maintained a very high position, which was surprising since it had no significant support factors. Now we are observing the opposite scenario: the dollar is rising for various reasons, and the movement strongly resembles inertia, but still, it is logical and regular.

Precisely because the euro had been rising for a long time without clear reasons, its current decline is logical and justified. At this time, the market is simply restoring the fair value of the pair based on the current rates of the ECB and the Fed and the economic conditions of the EU and the USA. We believe that the decline can well continue into the range of $1.00–$1.02.

The only concern that remains is the triple-oversold condition of the CCI indicator. We did see a correction at the end of last week; however, it was too weak to consider it an oversold bounce. We still believe that the correction should be stronger, but now, it seems, we will have to wait for a few hundred more points before it starts.

Euro should be wary of new statements by Lagarde and de Guindos. This week, there won't be many important events and publications in the European Union. On Monday, the Business Activity Index in the manufacturing sector for September and the unemployment rate were already published. Both of these reports turned out to be neutral, and the decline of the euro is clearly not related to them. Today, we have the speech of ECB Chief Economist Philip Lane, from whom it is extremely difficult to expect hawkish statements when everyone knows that he supports the option of keeping the rate at the current level for a long time. So, what reaction can Mr. Lane trigger? Either a new decline of the euro or nothing.

On Wednesday, retail sales, the producer price index, and the final value of the Business Activity Index in the services sector for September will be published. All of these are secondary reports that can only cause a local market reaction. Speeches by Lagarde, Panetta, and de Guindos are also unlikely to change the overall market situation, as it is unlikely that any of the ECB policymakers will suddenly adopt a more hawkish stance. On Thursday, there will be new speeches by de Guindos and Lane, from which we can expect the same as from all previous speeches by representatives of the European regulator's monetary committee: either pressure on the euro or nothing. On Friday, the European Union's event calendar is empty.

So, what do we have this week, in summary? There are plenty of fundamental and macroeconomic events, but few of them are significant. Speeches by Lagarde, de Guindos, or Lane could provoke a new decline of the European currency, but even without their assistance, the euro is doing well moving south. Much more importance will be attached to the macroeconomic statistics from across the ocean, which we will discuss in the next article.

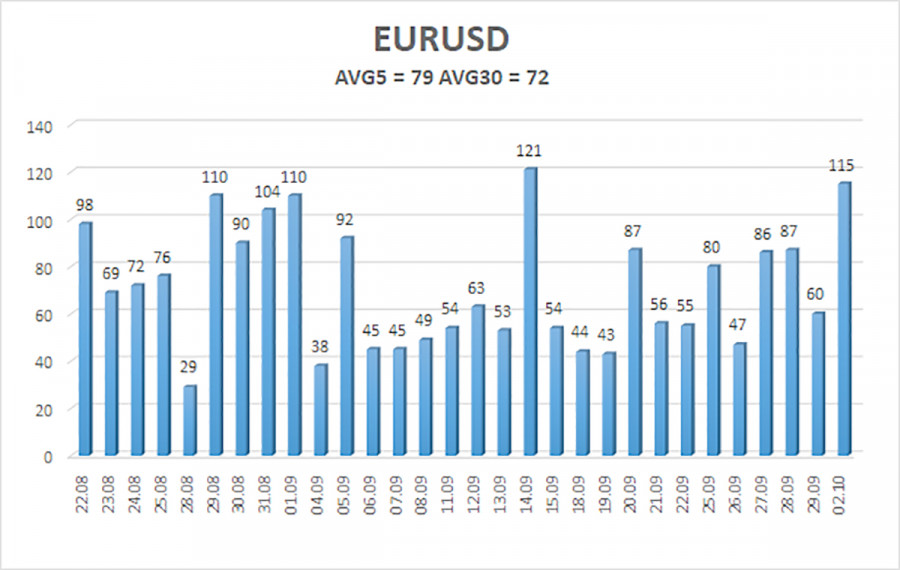

The average volatility of the EUR/USD currency pair over the last 5 trading days as of October 3rd is 79 points and is characterized as "average." Therefore, we expect the pair to move between the levels of 1.0384 and 1.0542 on Tuesday. An upward reversal of the Heiken Ashi indicator will indicate a new phase of corrective movement.

Nearest support levels:

S1 - 1.0376

S2 - 1.0254

S3 - 1.0132

Nearest resistance levels:

R1 - 1.0498

R2 - 1.0620

R3 - 1.0742

Trading Recommendations:

The EUR/USD pair continues its downward trend and has quickly completed its correction. You can now remain in short positions with targets at 1.0384 and 1.0376 since the price has not settled above the moving average. Long positions can be considered if the price establishes itself above the moving average line with a target of 1.0620.

Explanations for the illustrations:

Linear regression channels - help determine the current trend. If both are pointing in the same direction, it means the trend is currently strong.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the probable price channel in which the pair will trade over the next day, based on current volatility indicators.

CCI indicator - its entry into the overbought area (above +250) or oversold area (below -250) indicates that a trend reversal in the opposite direction is approaching.