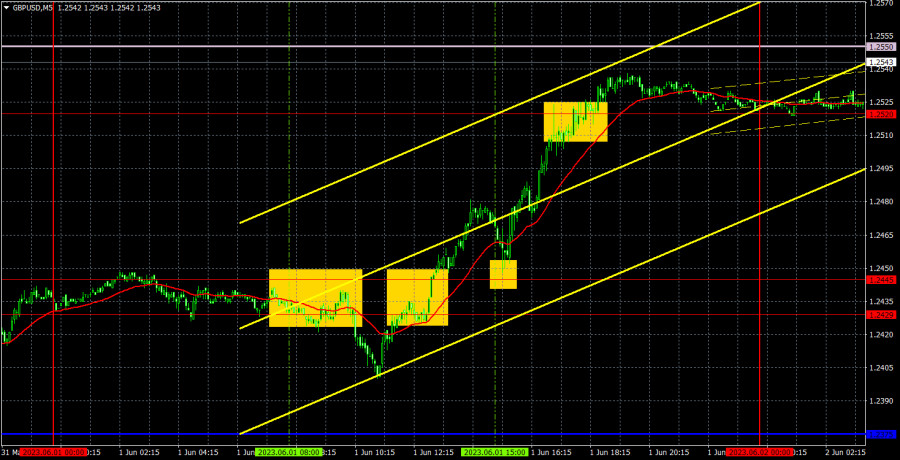

5M chart of GBP/USD

On Thursday, the GBP/USD pair grew "out of nowhere" again. And it was an impressive one at that. Take note that there was no significant news from the UK this week. If, for example, the Bank of England had made hawkish statements, the movement would have been understandable. However, all the data that influenced the market came from overseas, and many of them favored the dollar. The situation with the euro is slightly different, which explains its growth. After all, yesterday and the day before that, several important reports were released in the EU, two speeches by European Central Bank President Christine Lagarde took place, and the ECB minutes were published. But it is very difficult to say why the pound is rising again.

However, we did experience a good intraday trending movement yesterday, which made the trading signals strong and profitable. Initially, the pair consolidated below the range of 1.2429-1.2445 and managed to move down by about 20 pips, allowing for setting a stop loss at breakeven and leaving the trade without losses when the pair consolidated above the mentioned range. Based on the buy signal, long positions should have been opened, and the price subsequently surpassed the nearest target level of 1.2520. The trade should have been manually closed in the evening, resulting in a profit of about 75 pips, which is quite good. But let's reiterate: it is convenient to trade when there is a strong and trend-driven movement. It is necessary to avoid flat markets.

COT report:

According to the latest report, non-commercial traders closed 8,100 long positions and 7,100 short ones. The net position dropped by 1,000 but remained bullish. Over the past 9-10 months, the net position has been on the rise despite bearish sentiment. The pound is bullish against the greenback in the medium term, but there have been hardly any reasons for that. We assume that a prolonged bear run has begun. COT reports suggest a bullish continuation. However, we can hardly explain why the uptrend should go on.

Both major pairs are in correlation now. At the same time, the positive net position on EUR/USD shows the end of the uptrend. Meanwhile, the net position on GBP/USD is neutral. The pound has gained about 2,300 pips. Therefore, a bearish correction is now needed. Otherwise, a bullish continuation would make no sense even despite the lack of support from fundamental factors. Overall, non-commercial traders hold 57,600 sell positions and 69,200 long ones. We do not see the pair extending growth in the long term.

1H chart of GBP/USD

In the 1-hour time frame, the pair has started an upward movement, surpassing all the lines of the Ichimoku indicator. The pound doesn't exactly have grounds to buy the pound, which remains heavily overbought. However, take note that the market has the right to trade regardless of the fundamental and macroeconomic backdrop. The only thing I can say is that the movement doesn't correspond to the nature of the reports and news.

On June 2, trading levels are seen at 1.2269, 1.2349, 1.2429-1.2445, 1.2520, 1.2589, 1.2666, 1.2762. Senkou Span B (1.2550) and Kijun-sen (1.2375) lines may also generate signals when the price either breaks or bounces off them. A Stop Loss should be placed at the breakeven point when the price goes 20 pips in the right direction. Ichimoku indicator lines can move intraday, which should be taken into account when determining trading signals. There are also support and resistance which can be used for locking in profits.

Today, the event calendar is empty in the UK. On the other hand, the United States will release its highly anticipated Nonfarm Payrolls and unemployment reports. We have no doubt that the market will react to them, and the reaction could be practically anything - it is currently impossible to predict the values of the reports.

Indicators on charts:

Resistance/support - thick red lines, near which the trend may stop. They do not make trading signals.

The Kijun-sen and Senkou Span B lines are the Ichimoku indicator lines moved to the hourly timeframe from the 4-hour timeframe. They are also strong lines.

Extreme levels are thin red lines, from which the price used to bounce earlier. They can produce trading signals.

Yellow lines are trend lines, trend channels, and other technical patterns.

Indicator 1 on the COT chart is the size of the net position of each trader category.

Indicator 2 on the COT chart is the size of the net position for the Non-commercial group of traders.