Throughout Wednesday, the EUR/USD currency pair tried to continue the upward correction, but it didn't go well. Several hours before the conclusion of the Fed meeting, the price did manage to stay above the moving average. Still, there was no significant meaning in it, as the pair plummeted like a stone after the announcement of the results. Despite the ongoing rise of the dollar, which is in line with our expectations, a correction is possible soon and could be substantial. First, we note that the CCI indicator has entered oversold territory twice already. The third entry will be critical, after which the pair's rise (a substantial rise, not just by 70 points) must begin. Second, the American currency has been strengthening for two months. Third, the dollar is rising on any news, even those against it.

Let's delve deeper into the third point. Last Thursday, the ECB raised its key rate by 0.25% but signaled that the "end" is near. The market reacted with a euro sell-off because the tightening cycle was ending. Yesterday, the Fed left its key rate unchanged but indicated another rate hike was possible by the end of the year. The market responded with vigorous purchases of the American currency. Where is the logic? The logic is the same as for the past year when the euro rose for any reason or without reason. The European currency was appreciating at a time when the ECB was raising rates slower and less aggressively than the Fed, and very few experts questioned why the euro was getting stronger.

We have consistently argued that such a move is entirely illogical, and there will be a reckoning sooner or later. And now we are witnessing the same strengthening of the American currency - seemingly without reason but entirely justified when considering the euro's annual rise that preceded it. The 38.2% Fibonacci level on the 24-hour TF (1.0609) has already been worked out, and today, the pair may pierce it from above, after which a correction may begin.

Did Powell adhere to an "ultra-hawkish" rhetoric?

In short, no. Nothing ultra-hawkish came out of his mouth. Recall that a few months ago, Powell announced that the Fed was slowing the pace of monetary policy tightening to 0.25% per two meetings. Therefore, yesterday's decision to keep rates unchanged aligns with the outlined tightening step. At the same time, inflation in the United States has accelerated over the past two months, so some experts (including us) speculated that the Fed might spring a surprise. As we can see, there were no surprises, but the U.S. currency still strengthened. Let's look at Jerome Powell's main points at the press conference.

The head of the Fed noted that there is still a long way to go to reach 2% inflation. If necessary, the Fed will raise rates as many times as needed. Monetary policy will remain "tight" until inflation returns to the target level. Despite the statements made by Janet Yellen a few weeks ago about the possibility of a "soft landing" for the U.S. economy, Jerome Powell does not consider it a top priority. Rising energy prices could once again drive up the consumer price index, and inflation risks, unfortunately, remain on the upside.

Thus, the market assumed yesterday that the Fed would raise rates two or three more times, which was impossible to anticipate and trade in advance, or we are witnessing a momentum-driven dollar rise. The second scenario is more likely, so we expect a correction soon. Naturally, a clear and strong rebound from the level of 1.0609 will be a strong signal for its beginning. If the price stays above the moving average, it could also indicate that bears will take a break for several weeks.

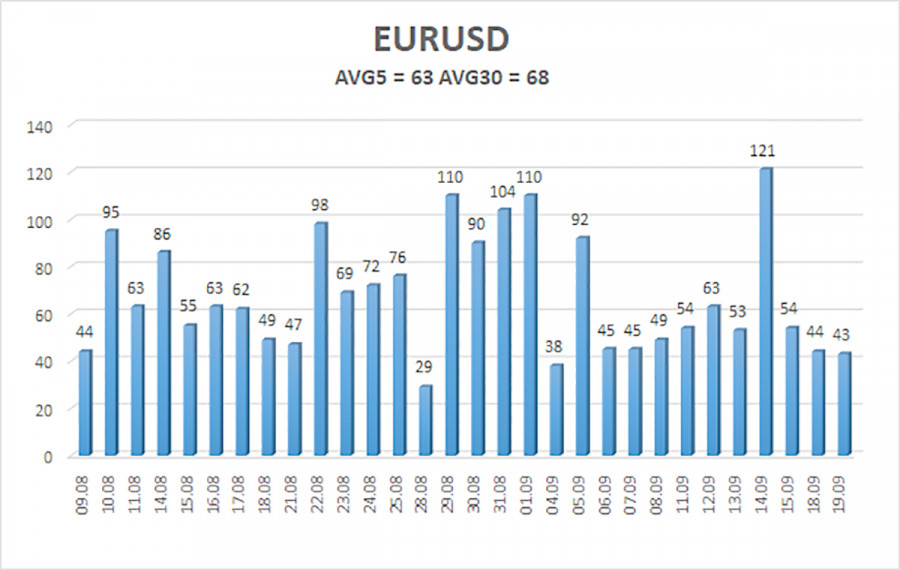

The average volatility of the EUR/USD currency pair over the past five trading days as of September 21 is 70 points and is characterized as "average." Therefore, we expect the pair to move between the levels of 1.0565 and 1.0705 on Thursday. An upward reversal of the Heiken Ashi indicator will signal a turn in the upward correction.

Next support levels:

S1 - 1.0620

S2 - 1.0498

Nearest resistance levels:

R1 - 1.0742

R2 - 1.0864

R3 - 1.0986

Trading recommendations:

The EUR/USD pair continues its downtrend. It is advisable to remain in short positions with targets at 1.0565 and 1.0498 until the price is above the moving average. Long positions can be considered if the price is confirmed above the moving average, with targets at 1.0742 and 1.0864.

Explanations for the illustrations:

Linear regression channels - help determine the current trend. If both point in the same direction, the trend is currently strong.

The moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel the pair will trade over the next day, based on current volatility indicators.

CCI indicator - its entry into the overbought territory (above +250) or oversold territory (below -250) indicates that a trend reversal in the opposite direction is approaching.